Current Price: $170 Price Target: $215

Position size: 2% TTM Performance: +35%

Key Takeaways:

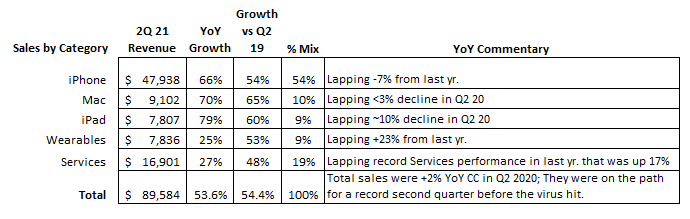

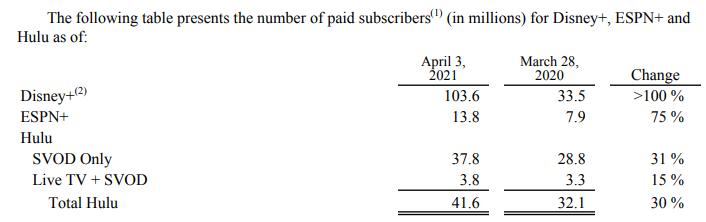

- Revenue was a slight miss, but they beat on earnings w/ weaker than expected Disney+ subscriber numbers – after a few quarters of big beats on subs, this quarter they beat on Hulu and ESPN subs and missed on Disney+ subs. The stock was down on this news. Weaker numbers not concerning and are partly impacted by delayed launch in LATAM and Covid related content delays.

- They had 104m Disney+ subs vs expectations for 109m subs. Despite this quarters numbers, overall Disney+ is still ramping way faster than expected, faster than NFLX and with no change to long term targets.

- Positive commentary on theater re-openings – announced two films opening exclusively in theaters in Aug (Free Guy) and Sept (Shang-Chi) amidst “recent signs of increased consumer confidence in movie-going.”

- Parks are recovering – parks are open (except Paris), operating at capacity limits, showing promising signs of future demand and open parks contributing to profitability. Shanghai Disney Resort is operating above FY ’19 levels.

Additional highlights:

- They now have 159M subs across Disney+, Hulu and EPSN+. That is second only to Netflix, which has about 204M. Disney+ now has 104M subs, Hulu is ~42M and ESPN has ~14M. Goal is 230-260m Disney+ subs by 2024.

- Weaker subscribers not concerning – subs this month were weaker than expected and they gave sub guidance for Q2 below consensus. Weaker numbers in part driven by Covid crisis in India and by pushed back launch in Latin America (timing the launch w/ key sports content). Despite that, in general they are ramping faster than anyone expected, they’re still in the early stages of their global rollout.

- ARPU was lower than expected but should steadily rise over time – ARPU at Disney+ Hotstar was down significantly versus Q1 due to lower advertising revenue as a result of the timing of IPL cricket matches and the impact of COVID in India (~1/3 of Disney+ subs). They had planned price increases in some markets that were put in place at the end of the quarter that haven’t had an impact yet. Lower Disney+ fees are largely driven by lower fees outside the US, but they will gradually continue to raise prices over time and they have ways (other than sub fees) to make money off of their content w/ advertising, parks and consumer products (especially w/ content like Pixar, marvel, star wars).

- Flexibility is a key component of their distribution strategy. They have 3 approaches for distributing films. 1) Release in theaters with a simultaneous offering via Disney+ Premier Access, 2) release straight to Disney+, and 3) traditional exclusive theatrical releases. Hybrid releases mitigated the impact of theater closures, but theaters are re-opening and they intend to continue to use this model.

- Content updates…

- Returning to full production at their studios

- Searchlight’s Nomadland (now on Hulu) took home Oscars for Best Actress, Best Director (w/ Chloe Zhao becoming the first woman of color to win the award), and Best Picture.

- Pixar’s Soul (now on Disney+) took home Oscars for Best Animated Feature and Best Original Score

- Moving more content to ESPN+ over time will mitigate cord cutting – “While our overall strategy is still very supportive of our Linear business, given the important economic value it drives for the company, we are also building out our ESPN+ Direct-to-Consumer offering. And with every deal we make, we are considering both the Linear and DTC components.” They’ve had some recent key ESPN+ additions w/ UFC, NFL, NHL, MLB, the PGA Tour, La Liga and Bundesliga (Spanish & German soccer leagues).

- Park re-openings…everything but Paris is open. Parks and resorts that were opened during the quarter all operated at significantly reduced capacities, yet all achieved a net incremental positive contribution during the period they were open – meaning revenue exceeded the variable costs associated with being open. They are not seeing labor shortages in terms of bringing cast members back to the parks.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$DIS.US

[category earnings ]

[tag DIS]