Current Price: $188 Price Target: $320

Position size: 3% TTM Performance: -18%

Key Points:

- Results alleviate concerns about the demand environment which has been weighing on the stock

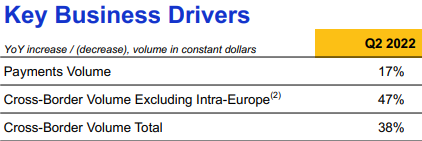

- Rev up 24% for the quarter, and expected to be up 20% for the year. Seeing broad based growth across every region in the quarter: 21% in the Americas, 33% in EMEA and 24% in APAC. And strong momentum across every Cloud in their Customer 360 Platform and across their industry verticals.

- Leading business indicators remained encouraging w/ remaining performance obligation (RPOs), representing all future revenue under contract, ended Q4 at ~$42B, +20% YoY. And Current RPOs or cRPO (all future revenue under contract that is expected to be recognized as revenue in the next 12 months) was ~$22B, up 21% YoY.

- Management’s tone on the conference call was very positive and called for no significant impact in demand because of macroeconomic concerns. In general, cloud and security software products are less susceptible to any IT budget cuts than hardware and on-premise software products.

- CEO said: “we had a great quarter. We’re carefully watching the economic data. I know all of you are doing that as well. And so far, we’re just not seeing any material impact on the broader economic world that all of you are in. Our demand environment, the demand is very strong.”

- SaaS sector has defensive qualities given secular growth and recurring revenues…

- Over 90% of revenues are recurring and CRM is inexpensive relative to its peer group

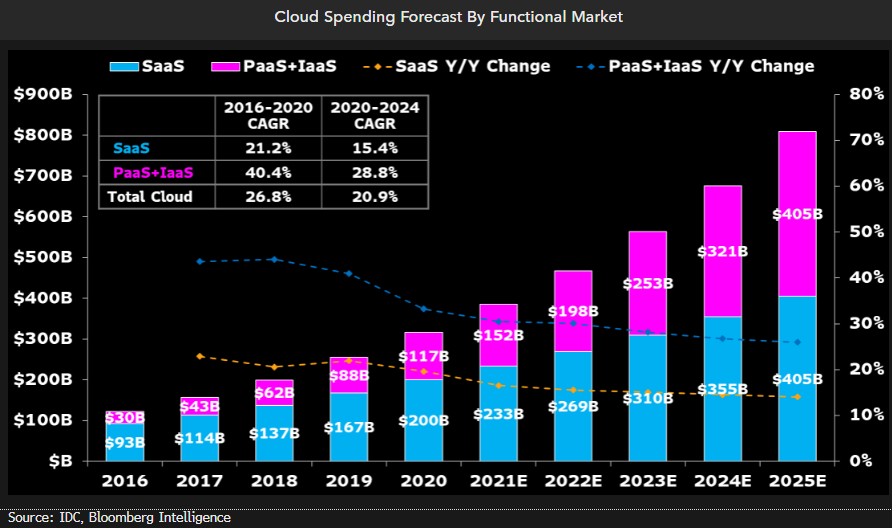

- Long-term path for growth…massive addressable market (expected to be $250B in 2025) that’s growing at a mid-teens CAGR and they’re taking share. They expect to hit ~$50B in revenue in 2026 which implies high teens annual top line growth.

- YTD Salesforce has traded off along with the rest of the software names, which have been among the worst performers in tech…as they are among the highest growth, longest duration and most susceptible to rising rates…

- Strong balance sheet…net leverage ratio <1x. In August they issued $8 billion of senior notes (to fund Slack deal) with a weighted average interest rate of 2.25 % and weighted-average maturity of 20 years. Concurrent with that, S&P upgraded their credit rating to A+.

- CRM is trading at a big discount to peers on a P/S multiple of ~4.7x calendar ’23 revenue (vs ~6.5x). Peer valuation comparison is often looked at this way to account for companies that high growth and not yet profitable. From this perspective, CRM is a rare company that’s growing profitably at scale.

- Valuation is supported by their high moat, leading market share, the visibility and stability of their recurring revenue model, high growth given multiple secular tailwinds and large addressable market, and their margin expansion opportunity. They are delivering on margin targets which will add to their FCF/share growth.

- Investment Thesis:

- Strong moat – dominant front office software that is mission critical and productivity enhancing to customers with high switching costs and an ecosystem advantage

- Solid long-term secular growth drivers – digital transformation, multi-cloud, industry verticals and international expansion

- Improving unit economics – growth strategy should yield higher quality (lower attrition) and higher recurring revenue cohorts which should improve margins over time and support their multiple

- Reasonably valued – high quality franchise, growing double-digits and trading at a discount to peers

YTD Salesforce has traded off along with the rest of the software names, which have been among the worst performers in tech…as they are among the highest growth, longest duration and most susceptible to rising rates…

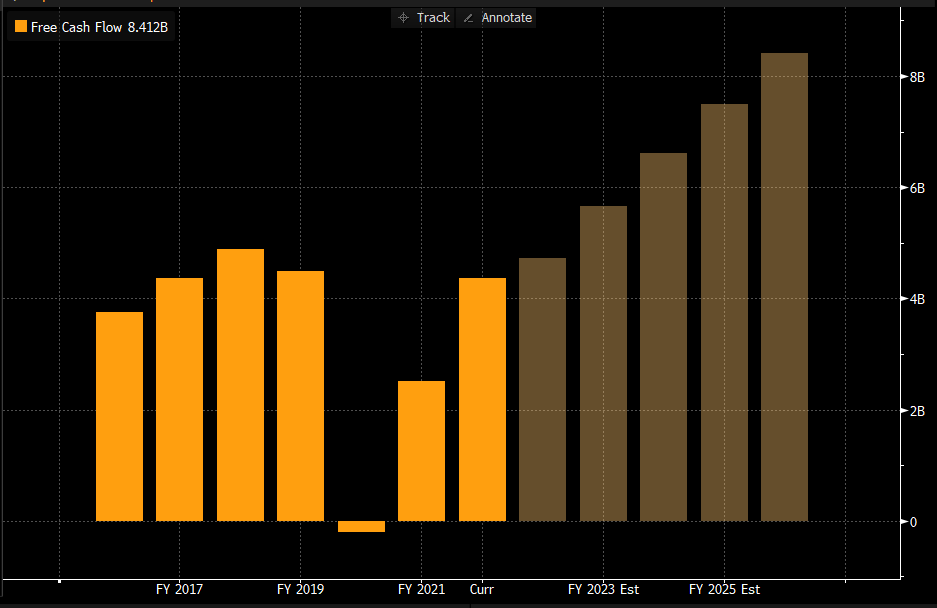

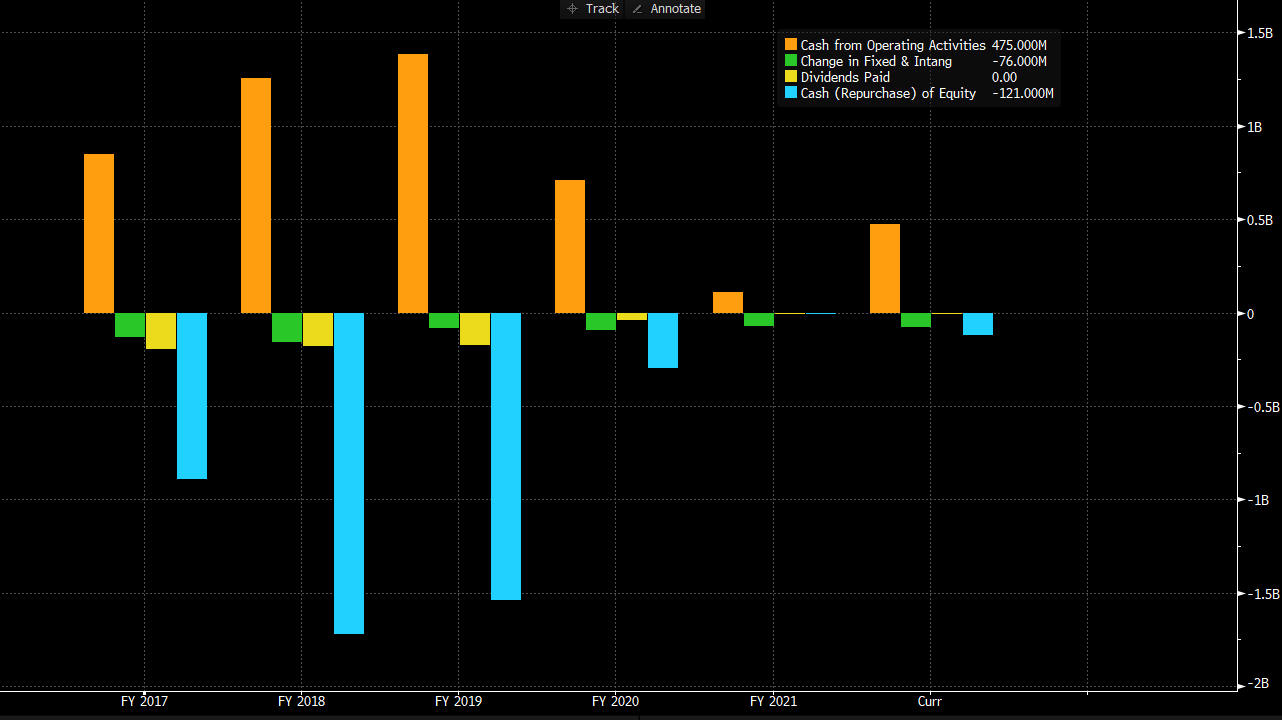

While CRM’s stock price has gone down YTD, free cash flow estimates for this year have held steady …

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109