FIQSX Commentary – Q1 2021

Thesis

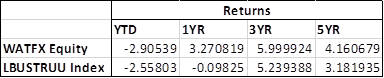

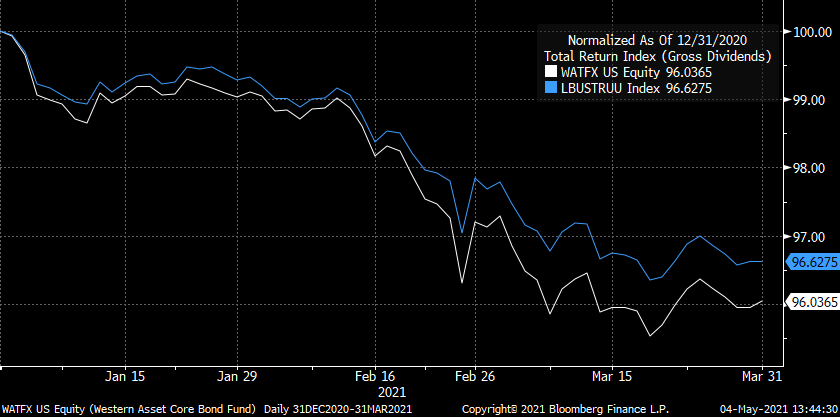

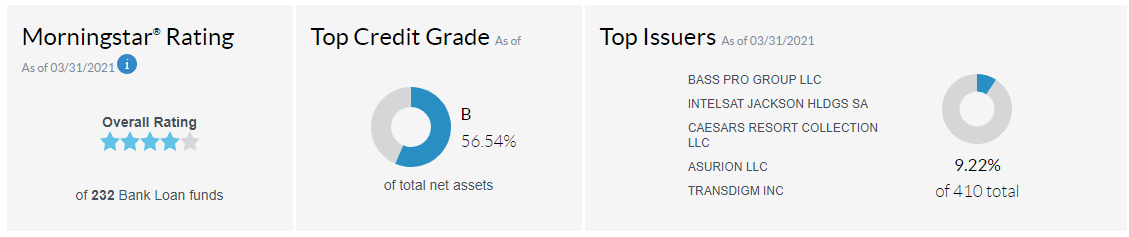

FIQSX (currently yielding 3.07%) is a large floating rate fund that has a strong historical returns and a tenured management team. By investing purely in senior bank loans, FIQSX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

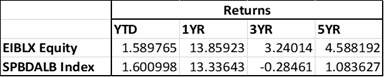

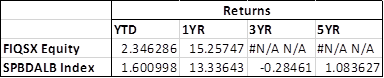

In the first quarter of 2021, FIQSX outperformed the benchmark (S&P/LSTA Leveraged Loan Index) by 22bps primarily due to a 2% stake in stocks of loan issuers that occurred because of company restructuring and negotiations. Security selection in oil & gas also contributed to performance. Overall exposure to bank loans, a small allocation to high yield credit, and selection in radio & television detracted from returns.

Q1 2021 Summary

- FIQSX returned 2.09%, while the Leveraged Loan Index returned 1.87%

- Quarter-end effective duration for FIQSX was 0.16 and 0.11 for the Leveraged Loan Index

- Largest contributors

- Chesapeake Energy – out-of-benchmark position in oil & gas

- Denbury – out-of-benchmark position in oil & gas

- Largest detractors

- Sinclair Broadcast Group – overweight in TV broadcaster

- Not owning loans from movie theater operator AMC Entertainment

Optimistic Outlook

- We hold this fund due to its relatively high yield and shorter duration, especially as we believe that rates will increase in the coming years

- Positive outlook as vaccinations continue to roll out, yet BB and B rated loans are moving closer to par

- The team will continue to search for opportunities in the loan space, even as BB and B-rated securities have approached par

- Continue to consolidate positions and reduce the number of holdings

- Remain overweight to BBB & above and BB, and underweight in B and CCC rated securities

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109