Position Size: 3.8% TTM Performance: 5%

Key takeaways:

· Better than expected SSS drove revenue and EPS beat. They didn’t issue guidance for Q4.

· Home category continues to be the bright spot & they are adding e-commerce. They already have sites for TJ Maxx and Marshall’s, but now adding HomeGoods.com next year.

· No guidance – but did see some weakening SSS trends in first two weeks of quarter.

· Seeing extremely plentiful inventory buying opportunities which bodes well for the future.

· Re-instating and increasing dividend by 13%.

Additional Highlights:

· All divisions saw sales above plan – home, beauty, and activewear businesses outperformed at Marmaxx, TJX Canada, and TJX International.

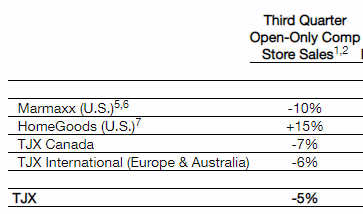

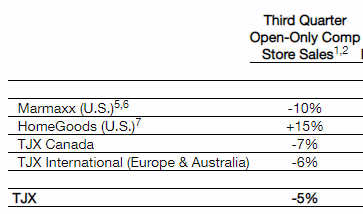

· They were planning overall “open-only” SSS to be down -10% to -20%…street was at high end of this at -11%. They well surpassed this with overall open-only SSS down -5%. HomeGoods was strongest at +15% and Marmaxx was weakest at -10%. Due to the temporary closing of stores from Covid, the historical definition of SSS is not applicable so they are temporarily reporting “open-only” SSS.

· Trends weakened slightly in the first two weeks of the quarter to down -7%. Overall open-only comp store sales were sluggish in August and improved significantly for the remainder of the quarter, with September being the strongest month, but then started to weaken in the last week of Oct.

· Slight margin contraction – Pre-tax margin down 70bps – very strong merchandise margin increase was more than offset by significant operating costs related to Covid and expense deleverage on the YoY sales decline.

· Store closures with virus resurgence in Europe – 470 stores are temporarily closed due to local government mandates – the vast majority of these stores are in Europe.

· Lighter inventory not due to availability – Inventories continue to be light due to a combination of factors, including lower planned store inventory levels, stronger than expected Q3 sales, and merchandise delivery delays due to continued bottlenecks in the supply chain, but merchandise flow to stores has improved since last quarter.

· Seeing extremely plentiful inventory buying opportunities which should benefit them in future quarters. Seeing new vendors across all categories reach out to do business w/ them. “Overall product availability in the marketplace remains excellent and the Company continues to shift its buying towards the categories that have had the strongest demand since reopening.“

· Adjusting inventories to align w/ current category demand trend – They are seeing softer demand for certain product categories given the number of people continuing to spend more time at home…“while we are emphasizing the high demand categories of Home, Beauty and Activewear, there is a limit to how much of our mix we would shift in the short-term to medium-term.” Ability to pivot has always been one of TJXs advantages. Centralized merchandising combined with high turns and constantly flowing goods to stores allows them to be nimble with inventory and respond to current trends. This has been a key part of their ability to drive LT positive SSS trends for decades.

· Their competition is suffering. Store closure leads to market share and real estate opportunities – better locations and lower rents. “Our relationships with vendors will grow even stronger as other retailers close stores.”

· Long-term thesis intact – Relative to other brick-and-mortar focused retailers, TJX continues to have a superior and very differentiated model. They acquire their inventory from an enormous (and growing) network of vendors, acting like a clearing mechanism for the retail industry…essentially opportunistically buying leftover/extra product that constantly flows from retailers, branded apparel companies etc. Growth of e-commerce has led to better inventory opportunities/ selection, not worse. They leverage their massive store footprint and centralized buying to merchandise their stores w/ current on-trend product. No one else does this at the scale they do. They have very quick inventory turns and can be nimble and re-active w/ their inventory buys and are an important partner to their sources of inventory. It’s a powerful model that continues to take share and, while they have a growing e-commerce business too, their store model has been very resistant to e-commerce encroachment. Moreover, they have a thriving Home business and a growing international store footprint and a track record of steadily positive SSS. Prior to this year, in their 43 year history they only had 1 year of negative SSS (this is unheard of!). So, with steadily positive SSS and a slowly growing store footprint, TJX steadily grows their topline w/ consistent margins that are about double that of department stores.

· Resumed and increased dividend. Generated $4.1 billion of operating cash flow and ended the quarter with $10.6 billion of cash. Announced a cash tender offer for up to $750 million aggregate for certain bonds issued in April – looking to lower borrowing costs by reducing the outstanding amount of higher interest rate longer-dated bonds and simultaneously issuing lower interest rate 7 to 10 yr. bonds to fund the tender offer.

· Valuation: Balance sheet remains strong. The stock has recovered from troughs and is up slightly YTD. Valuation reasonable at almost a 4% FCF yield on 2019.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

$TJX.US

[tag TJX]

[category earnings]