Key Takeaways:

1. They beat and issued re-assuring guidance. While guidance was lowered for next quarter and the full year due to impact from the coronavirus, they are not seeing a big impact. The street is only slightly ahead of the high end of full year guidance and lower travel re-imbursements (which are a pass through) are a 1pt headwind.

2. They are positioned well in the current environment. Their business model is set up for them to shift seamlessly to a work-from-home and virtual collaboration environment and they are helping clients make this transition as well.

3. Bookings were particularly strong signifying solid business fundamentals prior to the coronavirus.

4. Their scale will help them weather this and should lead to further share gains. Part of Accenture’s strategy and competitive advantage is to continue to innovate and invest to stay relevant. Given their scale and strong balance sheet, they are in a position to continue doing that…they plan to continuing making small acquisitions (which should be getting cheaper) though the remainder of the year and they plan to continue investing on training and upskilling employees.

Additional highlights:

· 2Q revenues were $11.1B (+8% YoY in CC) and operating margin of 13.4% (+10bps YoY). They saw growth in 12 of their 13 industry groups, with 5 growing double-digit…underscoring the benefit of diversified industry end markets. The one area of weakness that has been persisting for a bit is European financial services end markets. From a geographic perspective, US, “growth markets”, Germany, Ireland, Brazil, Japan all grew double digits. Europe overall was +2% and the UK declined.

· They continue to take share growing more than 2x the market.

· Record bookings of $14.2 billion for the quarter, a 1.3 book-to-bill (consulting 1.1 and outsourcing 1.4).

· Guidance:

o Lower travel reimbursements weighed on guidance. For the fees that are reimbursable to clients, this shows up in revenue but is just a pass through….i.e. zero margin. Less travel mean less revenue, but no economic impact.

o For next quarter they expect constant currency revenue growth of -2% to +2%. For the full year they expect +3% to +6% revenue growth (vs +6-8% previously). Importantly, Q3 revenue is expected to see a 2pt hit from lower travel and full year a 1pt hit…thus accounting for half of their 2pts of FY lowered guidance.

o Lower travel spend that is not reimbursable will be a benefit to Accenture’s full year margins. They are expecting at least 10bps of full year op margin expansion.

o Within the FY20 revenue growth guidance, Consulting is expected to grow at low-to-mid single digits while Outsourcing is expected to grow at mid-to-high single digits. Their consulting business incurs higher travel fees.

o In their full year guidance they are assuming some improvement by Q4 either because virus containment improves or, failing that, that clients become more accustomed to operating in a new environment which should help mitigate any project disruptions.

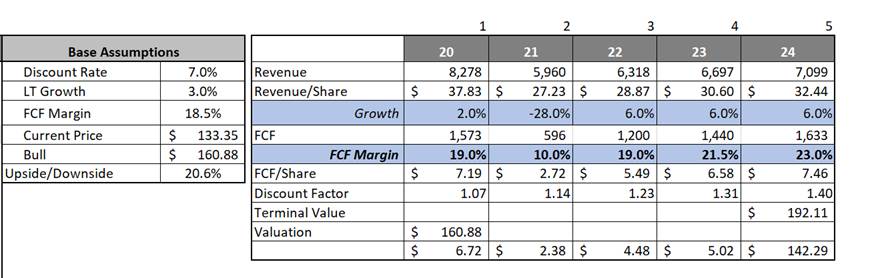

· Valuation:

o The stock is meaningfully undervalued trading at a 6% forward yield. They have an easily covered 2% dividend and no net debt.

o They have $5.4B in cash on their balance sheet. The only debt they have on their balance sheet are capitalized leases, which were added this fiscal year due to an accounting change. Substantially all of their lease obligations are for office real estate. Based on last year’s 10K, annual operating lease commitments look to be <$700m.

o Multiple underpinned by ACN being a best-in-class company with stable growth that’s buffered by geographic and end market diversity and long-standing client relationships (95 of their top 100 clients have been with them for >10 years).

· Coronavirus: relative to many other companies, they seem well positioned to address the impacts both to their own business and to help clients adjust. For instance, Accenture does not have a headquarters. Top leaders are spread across the globe. They’ve operated this way for over three decades. So, they say, mobilizing to address this situation has been seamless. A significant portion of employees working from home including 60% of their huge number of employees in India and the Philippines. Some work cannot be done from home, in these cases, they reduced the density of people in their offices. To date, they have not experienced any material service interruptions.

Including some quotes from the earnings call….an interesting insight into Accenture’s positioning and into implications of the current situation for companies generally.

· “we are deeply experienced in working virtually, and already have deployed at scale in the normal course in our business collaboration technologies and infrastructure for remote working. For example, we’re the largest user of teams by Microsoft in the world. And in the last few weeks, as we rapidly ramped more people working remotely from home, teams’ audio usage has almost doubled from our typical 16 million minutes per day to almost 30 million minutes per day. We are using our deep experience of working together virtually across Accenture and with our clients to help adapt how we work together from home.”

· “Our clients are adjusting to the need to have remote working, which for many of our clients is very new, and we’re helping many of our clients make that adjustment. So for example, we have a client who asked us literally to go and we partner with Microsoft to do this, to go from zero people using teams, in five days, it’ll be — their entire 61,000 workforce. So in 5 days, 0 to 61,000.”

· “if you look at the work that we’re doing with our clients, we’re working very closely to them on mission critical services… we do the settlement of services of trades with major banks. We do payroll services. We support many different healthcare services. We’re doing trust and safety services, keeping the Internet safe. So there is a big focus in this first phase on mission critical services, working together with our clients, being able to do that in some cases remote, in some cases continuing to go into the centers…. much of the work that we do for our clients is mission critical or critical to their agendas.”

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$ACN.US

[tag ACN]

[category equity research]