Key takeaways are:

1. Better than expected Disney+ subscriber numbers of 26.5m subs (consensus ~20m) for Q1 and 28.6m subs as of Monday.

2. Headwinds: Coronavirus impact is manageable and temporary which negatively impacted guidance by $280m. Seeing some impact from cord-cutting which is expected and offset by DTC over time.

3. Despite this, long-term fundamentals remain strong, as Disney’s subscriber numbers demonstrate the quality of their content puts them in a solid position to win viewers that shift from cable TV bundles to streaming

Share price: $140 Target price: $165

Position size: 1.8% 1 yr. return: 28%

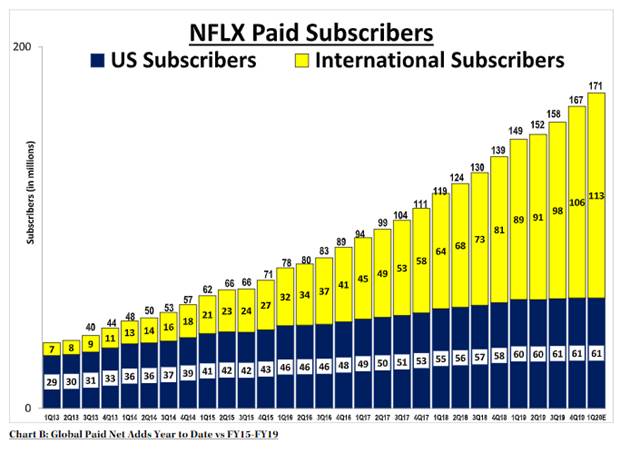

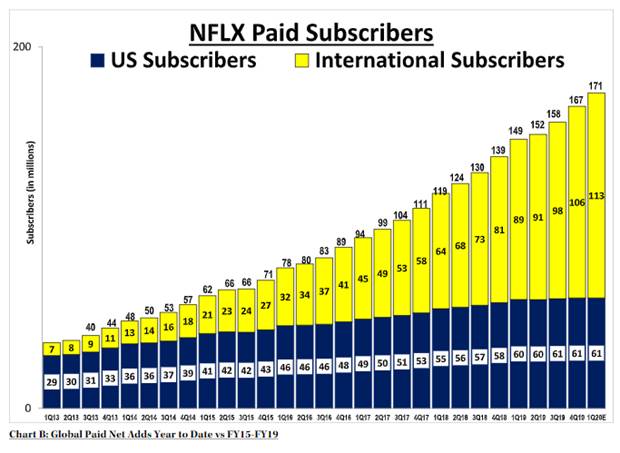

Disney beat expectations for revenue and earnings and reported impressive subscriber numbers on Disney+ of 26.5m subs (consensus ~20m) for Q1 and 28.6m subs as of Monday. These subscribers are mostly domestic, with big international launches coming later this year. They have already almost hit the 30m US subs that mgmt. was targeting in year 5. They are ramping this business far faster than Netflix, which took several years to hit that mark and has ~62m US subs after over a decade. Better subs and solid ARPU mean the economics of DTC are tracking ahead of expectations.

A key headwind for Disney right now is the coronavirus which negatively impacted guidance by $280m due to the closure of their Shanghai and Hong Kong parks. The full impact is not clear yet as the length of closures is uncertain, but their Int’l parks business is much smaller and lower margin than their US parks. Theater closures could also impact Studio results. The Chinese box office varies a lot by movie (most recently, 8.5% for Frozen 2). Aside from the temporary impact of the coronavirus, they saw a negative impact to ad revenue in their Media segment from more cord cutting. This highlights the fact that Disney is juggling viewers shifting from cable bundles to Disney+, Hulu and ESPN+, which can be a tailwind to one segment and a headwind to another. Despite this, long-term fundamentals remain strong, as Disney’s subscriber numbers demonstrate the quality of their content puts them in a solid position to win viewers that shift from cable TV bundles to streaming and also their ability to profit from their intellectual property in multiple ways across segments. Over time, their DTC initiative should strengthen synergies between their businesses, lead to higher margins and a higher multiple on recurring revenue.

Highlights:

· EPS of $1.53 vs $1.46 consensus, driven largely by Studio and Broadcasting.

· Total revenue was slightly better than expected, with beats in all segments (especially Broadcasting and Studio) offset by higher than expected eliminations from licensing to DTC.

· Direct-to Consumer (DTC) & International:

o All DTC platforms, including ESPN and Hulu are tracking ahead of expectations. 7.6m ESPN+ subscribers (guidance of 8-10m in 2024). 30.7m Hulu paid subs (guidance of 40-60m in 2024). Of those, 3m pay for Hulu’s cable-like service, Hulu Live. Hulu is seeing strong ad revenue with their ad supported subscription level. Hulu will begin expanding internationally in 2021.

o Disney+:

§ Original guidance was for FY 2024 subs of 60-90m globally, w/ 20-30m in the US and 40-60m international. They didn’t raise guidance, but they are basically already at the high end of this in the US after less than 3 months.

§ Q1 op income losses associated with launch of Disney+ were lower than expected. Breakeven originally guided to 2024. Given better subs and solid average revenue per user, the economics of this business is tracking better than expected.

§ Key investor concerns overcome: investors questioned how big contribution of Verizon offer for free 1 year of Disney+ with unlimited plans would be and also questioned whether churn would spike following the end of The Mandalorian season one which ended on 12/27. The contribution from Verizon free offer was lower than expected (5-6m subs). Subs have continued to increase since the end of Dec. with broad-based viewership across genres, which helps validate the appeal of their content beyond key new exclusives. So far, churn and conversions from free trials to pay have been better than expected.

§ NFLX comparison: Disney went from 10m subs on day 1 (in November), to almost 29m now. NFLX reported 10m subs at the end of 2008. It took them until Q1 2013 to get to 29m. For sure, not an entirely fair comparison as streaming was a newer concept then and broadband speeds were slower, but still a benchmark. NFLX now has 169m subscribers (US is ~62m of that).

§ DTC geographic expansion will be a tailwind to sub growth: multiple geographies launching later this year including several European markets and India in March.

· Parks:

o Domestic park revenue +10% driven by pricing, higher guest spending and 2% attendance growth. Int’l parks results hurt by lower attendance in Hong Kong due to political events.

o They guided to a coronavirus 2Q op income headwind of $280m, which assumes their Shanghai and Hong Kong parks are closed for two months. The closures came at a lucrative peak travel time with Lunar New Year.

o Disneyland and Disney World make up the majority of revenue for this segment and at a much higher margin than their international parks.

o If the Coronavirus spreads and were to cause a closure of their US parks this would be a far bigger impact. Domestic Parks and Experiences (which includes cruise ships) is ~$4B or ~25% of their total operating income.

· Media:

o They had a good quarter with better broadcasting results, but an acceleration in cord-cutting could squeeze TV ad and affiliate revenue (though likely a benefit to DTC segment). ESPN saw ad revenue decline 4.5% this quarter, which was partially offset by higher pricing. Ad revenue was ~15% of total revenue in 2019 with 2/3 of this from the Media segment and the rest from DTC. Their growing DTC segment is an offset to this segment and ESPN+ could eventually be a home for more sports content over time.

· Studio:

o Frozen 2 was a big contributor this quarter. They are lapping a strong movie slate from last year. This business is hit driven and thus results can be lumpy.

o China could potentially weigh on results but impact should be small. Their next major film release is Mulan on March 27. This was expected to do well in China.

o China’s movie regulator typically allows only 34 foreign films to be shown in theaters each year. Attaining a slot can significantly boost a movie’s global box office. For example, China made up ~22% of Avenger Endgame’s total box office – which is larger than what’s typical and was the biggest Hollywood film ever in China. In general, super hero movies tend to do well in the Chinese market, more so than animated movies. Most recently, about 8.5% of Frozen 2’s box office was from China.

· Consumer Products:

o Strong sales of Frozen and Star Wars merchandise

o Baby Yoda from the Mandalorian has apparently “taken the world by storm.”

Investment Thesis:

- Disney is a global media and entertainment company that owns a massive library of intellectual property.

- Their competitive advantage is their evergreen brands and synergistic business model. Disney can create content that builds off existing franchises and can be monetized across all their business, giving them the ability to create higher budget, quality content and an ever growing library of IP.

- New direct-to-consumer (DTC) initiative will strengthen synergies between businesses and lead to structurally higher margins and higher multiple on recurring revenue business.

- Recent Fox acquisition improves their content positioning and global growth opportunities.

- High quality company with solid balance sheet, strong FCF generation and ROIC.

$DIS.US

[category earnings]

[tag DIS]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109