Current Price: $44 Target Price: $63

Position size: 3.7% TTM Performance: 1%

CSCO reported good Q1 results, but guided below expectations for next quarter. Revenue growth guided to -3% to -5% vs street +2.7% and adj. EPS guided to $0.75 to $0.77 vs street $0.79. The weakness was attributed to a weakening macro environment, not company-specific issues. Last quarter they said they saw early signs of macro weakness. They said the macro environment has continued to deteriorate and was broad-based across all end markets (except public sector) and geographies. While weakening business confidence and a resultant slowdown in enterprise spending would be a headwind for them, the secular drivers that Cisco stands to benefit from are very much intact. Long-term Cisco will benefit from a product refresh cycle that is ultimately driven by increasing data traffic. With rising data traffic, technologies are changing (5G, IoT, WiFi 6) and networks are becoming more complex – Cisco’s products help companies solve for that by helping them simplify, automate, and secure their infrastructure. Capital return program should limit downside – buying back shares and now >3% dividend yield that’s easily covered (helps provide a floor, especially w/ falling rates).

Thesis intact, key takeaways:

· Deteriorating macro conditions across every region and now expanding into the Commercial (SMB’s) and Enterprise verticals. Mgmt said commercial tends to be the most resilient and they saw broad based weakening with those customers across the globe. They pointed to weakening business confidence as a result of macro uncertainty due to trade wars, Brexit, Hong Kong, uncertainty in Latin America, upcoming US elections and potential impeachment.

· In terms of macro softening management talked specifically about smaller deal sizes and approval process across industries getting longer…a leading indicator of tightening corporate budgets.

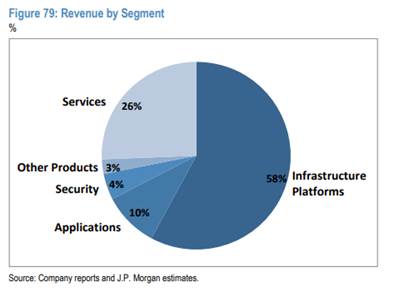

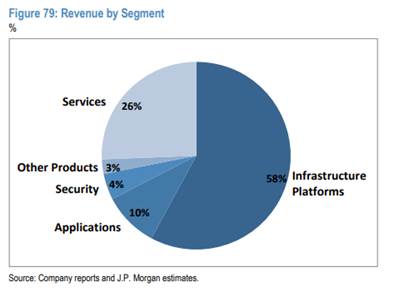

· Infrastructure Platforms (largest segment, ~58% of revs) was down -1.4% YoY. Similar to last quarter, all the businesses were up except for routing from soft Service Provider (cable and telecomm companies) demand. Switching had growth in both campus and data center with the continued ramp of the Catalyst 9000 and strength of the Nexus 9000 (both sold w/ 3-5yr software agreements). Management commented that the campus refresh cycle continues to be strong.

· Strong performance in Applications (+6% YoY) and Security (+22% YoY).

· Service revenue was up 4%, driven by software and solution support.

· Gross margins and op margins better than expected, in part benefitting from the positive impact of rising software mix.

· By end markets, Public sector order metrics remained strong (+6% YoY) while enterprise and commercial were each down 5%, and service provider was down 13%.

· By geography, Americas and EMEA were each down 3% and APJC was down 5%. Total emerging markets were down 13% with the BRICS plus Mexico down 26%. China is <3% of sales, revenue was down 31% in Q1 (was down 25% last quarter).

· Product mix continues to improve with more software/subscription. By year end, they target 50% of their revenue to be from software and services – a target which they reiterated they will hit. Subscription revenue was 71% of total software revenue, up 12pts YoY and 5 points sequentially. This transition will drive an upward trend in CSCO’s margins over the next several years.

Valuation:

· They have a >3% dividend yield which is easily covered by their FCF.

· Capital allocation strategy of returning a minimum of 50% of their FCF to shareholders annually through share repurchases and dividends. Their annual dividend is $6B.

· Forward FCF yield is ~7.5%, and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on a hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco:

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Cisco is the leader in enterprise switching and service provider routing and one of the few vendors that can offer end-to-end networking solutions.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!