Harding Loevner Emerging Market Fund Commentary – Q3 2021

Thesis

HLMEX utilizes fundamental research to find companies with strong quality and growth metrics that can be compared across the global landscape. By focusing on investments with competitive advantages, long-term growth potential, quality management, and corporate strength, HLMEX offers diversity to our EM allocation while generating alpha over the long run. We continue to hold the fund because of the team’s conviction in high quality companies and managed risk through diversification and evaluation.

[more]

Overview

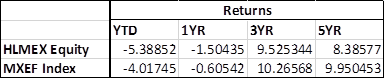

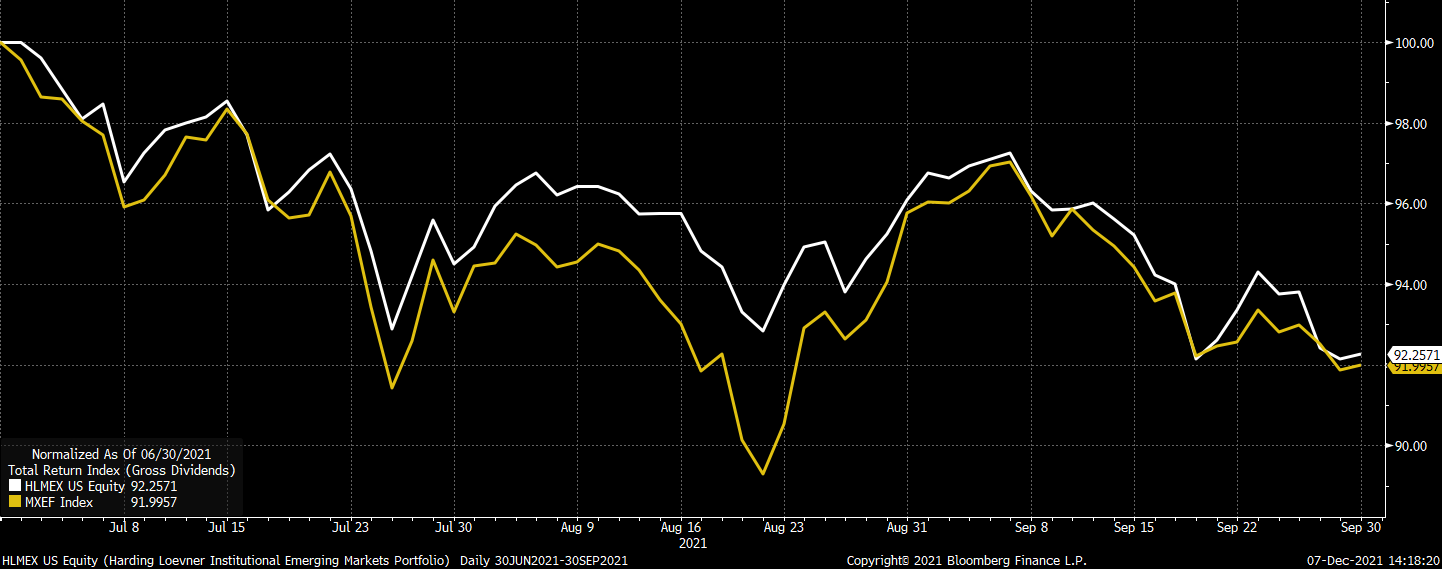

In the third quarter of 2021, HLMEX outperformed the benchmark (MSCI Emerging Markets Index) by 94bps. Allocation effect had the greatest positive impact on performance. An overweight to Financials and underweight to Consumer Discretionary contributed most to returns. Strong selection within Consumer Discretionary and strong performance by Information Technology also helped the fund’s returns. Zero exposure to Materials and poor selection in Consumer Staples and Utilities detracted from performance for the quarter. Regionally, overweight to Russia and Mexico, and an underweight to China benefitted the fund, while underweights to small cap and India offset these positive returns.

Q3 2021 Summary

- HLMEX returned (7.15%), while the MSCI Emerging Markets Index returned (8.09%)

- Contributors

- Sector: Overweight to Financials, underweight to Consumer Discretionary, exposure to Information Technology

- Region: Overweight to Russia and Mexico, underweight to China

- Stocks: Siam Commercial Bank and Bancolombia (Thailand), Komercni Bank (Czech Republic), Kotak Mahindra Bank and HDFC Corp (India)

- Detractors

- Sector: No exposure to Materials, poor selection in Consumer Staples and Utilities

- Region: Underweight to smaller EMs and India

- Stocks: Sands China and ENN Energy (China), Largan Precision (Taiwan)

- Fund’s expense ratio dropped from 1.17% to 1.10%

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s focus on quality by emphasizing earnings growth and strong cash flow to gain attractive returns over the long run

- Concern around China being able to sustain high GDP growth and the country’s high level of debt

- The portfolio has shifted to now have Industrials as the largest overweight instead of Financials

- Continue to invest in durable growth – quality focus with attractive valuations

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109