This morning Fortive announced the acquisition of Accruent, owned by the private equity group Genstar Capital. Conference call at 8:30am.

Deal details:

· $2B in cash, financed by cash & debt

· expected to close in 3Q18, accretive to FCF and EPS in 2019

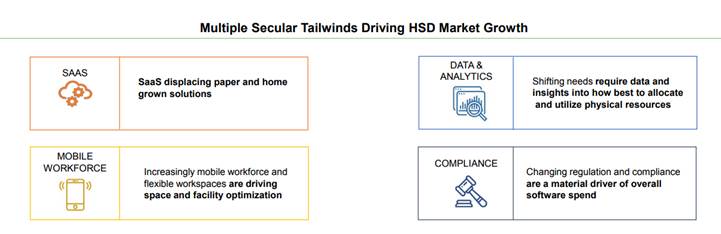

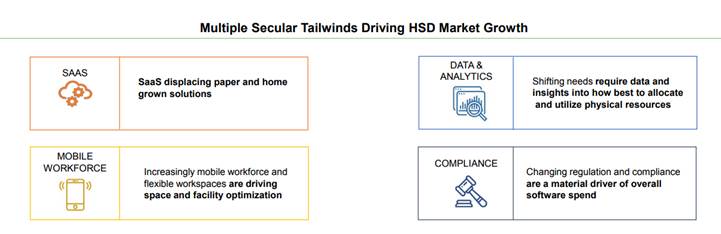

· fits Fortive’s strategy to add recurring revenue businesses, in the connected devices & IoT/data analytics

· 10% ROIC by year 6

· Synergies possible with Fluke and recently acquired Gordian

Company description:

· Accruent is a global software company that provides resources to companies to manage their facilities/real estate/physical assets in a cloud-based framework. This software tracks the full life cycle of real estate and facilities: capital planning, lease accounting, space management, field service management

· employs 1,100 employees and serves 10,000 global customers across a wide range of industries

· 20% of its revenues is international (serves 150 countries)

· total addressable market for Accruent’s software is $7B, #1 in this market

· revenue of $270M in 2018, 50% software-as-a-service, 70% recurring revenue base, high revenue retention and low cyclicality

· Adjusted EBITDA margins of 37%

· Long runway for additional M&A in that market

$FTV.US

[tag FTV]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!