I have attached the Monthly Market Monitor put together by Eaton Vance. As always, I recommend taking a look through the full presentation if you have the time. However, I have included a few helpful charts below.

Research Blog – INTERNAL USE ONLY

Fortive to acquire JNJ’s ASP medical sterilization unit

We had been waiting for Fortive’s next deal following the divestiture of its Automation & Specialty business to Altra for $3B. It was announced last night with the acquisition of JNJ’s medical sterilization unit for $2.7B. The deal is expected to close by early 2019. The EBITDA from the new business will offset the loss from the divested Automation business. The deal will be financed by cash on hand, new debt and/or equity.

What is the JNJ’s Advanced Sterilization Products business?

· Provides innovative sterilization and disinfection solutions and low temp hydrogen peroxide sterilization technology:

o Terminal sterilization: Manufactures capital equipment as well as accompanying proprietary sterilant cassettes, biological indicators and software that sterilize critical devices including laparoscopic and robotic instruments and stainless steel instruments. Installed base of >21k units with 8-10 year life.

o High-level disinfection: Manufactures cleaners, reprocessors and biocides for semi-critical devices such as endoscopes. Installed base of >9k units with 6-8 year life cycle.

o Services: Provides maintenance and repair of sterilization solutions ensuring critical uptime for hospitals.

· Global market leader with 80% recurring revenue base (in line with FTV growth strategy), a large installed customer base and good brands

· Provides entry into the medical sterilization and disinfection market:

o Strong growth sector

o International growth

· Expected to achieve 10% ROIC in 4 years

This unit hasn’t grown in the several years, in a market that grows mid-single digit. Being part of a large corporation such as JNJ, the unit might not have been a critical business the company was focused on. With $775M in sales last year, it is in line with FTV’s business unit size in the $1B range. EBITDA margin is 25%, which should be accretive to FTV right away.

We see this deal as positive for FTV, expanding its exposure in the non-cyclical medtech sector.

$FTV.US

[tag FTV]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

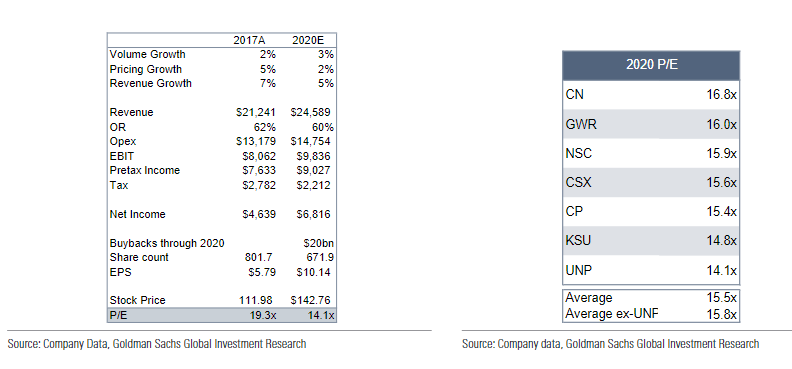

UNP Analyst Day Takeaways

Below is the summary of the positive data points that came out of yesterday’s analyst day:

· Management initiated a 60% Operating Ratio in 2020 (they walked away from their prior 60% by 2019 last quarter)

· Cadence of share repurchase is more aggressive than previously announced: $20B through 2020, and funded mostly from free cash flow

· Lower capex results in higher free cash flow conversion

· Dividend increase (implied to go to 2.5% from 2%)

· Leverage is going up from 2x to 2.7x. Management was reassuring that this increase would be gradual, and that they would remain prudent if the macro environment turns negative.

All these positive news might seem aggressive knowing that UNP didn’t meet its latest volume and operating ratio guidance, but we would assume they learned from that mistake and provided an update on guidance they feel comfortable achieving.

Below is GS valuation analysis, which shows UNP as being cheaper than peers assuming UNP meets its guidance on volume, pricing, OR and buybacks:

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

Review of the size effect in investing (AQR)

Below is a link to an article on investing in small cap stocks. The paper dispels the long held belief that small stocks outperform large cap stocks. The paper revisits and corrects prior studies that led investors to champion small cap stocks. These prior studies were distorted by pricing errors in the CRSP pricing database when a stock was delisted.

The study concludes that the small cap effect is weak at best and mostly explained away by higher beta and the value effect. I know several firms that drink the small-cap Kool-Aid. Should a client show concern at Crestwood’s modest allocation to small caps, this paper will support the construction of our models.

Thanks,

John

Medtronic MDT reported strong 4Q FY18 results and a conservative initial FY19 guidance

Thesis intact. Key takeaways from the quarter:

Medtronic reported strong 4Q FY18 sales and earnings results this morning with +6.5% organic sales growth and +6.5% EPS growth. Top line growth was robust across all segments, with Diabetes impressive at +21% (thanks to US patient demand for its insulin pump). Operating margin expanded (+80bps) in the quarter, thanks to cost savings initiatives.

The initial FY19 organic sales growth guidance of +4-4.5% is achievable and leaves room for upside, while operating margin should expand by 50bps (better than FY18 +20bps) and EPS growth in the +8-9% range. Management thinks that its emerging market business will grow in the low double digits going forward, following a +15.5% growth in 4Q. Free cash flow conversion will improve going forward, as litigation and tax payments diminish. The tax reform will push for more overseas assets liquidation to continue.

In an interesting move, MDT hired Michael Weinstein earlier this month, a well-regarded sell-side analyst (JP Morgan), to lead its strategy. He’s bringing a deep knowledge of the medtech space, and we can expect some M&A/divestiture/capital allocation moves in the coming year. The next catalyst will be when the company introduces its long-term outlook during its investor day on June 5th.

Valuation unchanged, we are maintaining our $93 price target, reflecting the recent strength in the business.

TJX 1Q19 Earnings Update

TJX beat on revenue and EPS with better than expected SSS. Performance was solid across divisions and concerns around inventory availability were dispelled. SSS were +3% vs guidance of +1-2% with strong performance across their apparel and home categories. Traffic was the primary driver across all 4 divisions. Marmaxx division (60% of revenue) SSS were +4% driven mostly by traffic and slightly by ticket. International SSS were +1% despite a “challenging retail environment” in Europe (where they have over 500 stores). Full year guidance is 1-2% SSS (in their 40+ yr. history they’ve had only 1 year of negative SSS). They also mentioned they “have been disproportionately attracting new millennial and Gen Z customers.” Merchandise margins compressed a little, but gross margins were flat. They are seeing some headwinds from wages and “significantly higher” freight costs, offset by positive Fx and a lower tax rate. The midpoint of full year guidance was raised despite these headwinds and with a lower expected tax benefit. Full year EPS should be about $4.07 plus a $0.72 benefit from a lower tax rate.

Cisco 3Q18 Earnings Update

Thesis intact, key takeaways:

Cisco reported Q3 earnings and beat on the top and bottom line and guided in line with street. While the quarter was strong, the growth of Services revenue (26% of revs) seemed to be a little lower than expected and gross margins were lower. They had 70 bps of gross margin compression driven almost entirely by higher memory costs. This is similar to previous quarters and is an industry wide phenomenon. They continue to make good progress on their transformation from a hardware business to a software and services focused business. The percentage of recurring revenue is now at 32% – they set a goal of 37% by 2020. Enterprise saw accelerated growth at +11% YoY driven by strong growth with Catalyst 9k units –the 9k switches are only sold with a subscription and are a key part their strategy of shifting their core business to recurring revenue. They saw strength in both campus and data center switching. Additionally, Applications and Security were both strong – up +19% and 11% respectively. As expected, Service Provider revenue trends continue to be weak, pressuring router sales – though exposure to this end market is decreasing. They repurchased $6.2bn worth of shares in Q3 and still have $25B remaining in their buyback authorization which they aim to complete in 1.5-2yrs.

Valuation:

· They have 3% dividend yield which is easily covered by their FCF.

· FCF yield of over 6.5% is well above sector average and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

TORIX – Q1 2018 Commentary

TORIX – Q1 2018 Commentary

During the quarter, Tortoise MLP & Pipeline Fund underperformed its benchmark. The MLP and broad energy sectors sold off during the quarter due to negative sentiment as well as uncertainty following a FERC ruling. The team remains optimistic about the space believing that commodity prices will remain stable and that companies are better positioned to self-fund capital projects. As of the end of last month, the TTM yield of TORIX is 3.09%.

TIREX – Q1 2018 Commentary

TIREX – Q1 2018 Commentary

During the first quarter, the TIAA CREF Real Estate Securities Fund outperformed its benchmark despite the negative return for the quarter. The team remains focused on higher-quality growth oriented REITs with superior supply/demand dynamics. As of month end, the 30-day SEC yield on TIREX is 2.56%.

Quick Update On Earnings So Far…

So far ~80% of the companies in the S&P 500 have reported earnings.

78% have beat on EPS. The 5-year average is 70%.

77% have beat on sales which is a record.

55% of companies have issued negative guidance which is well below the 5 yr average.

For EPS beats: consumer discretionary, tech and Energy have had the highest % surprise.

For revenue beats: REITs, Industrials and utilities have had the highest % surprise.

According to FactSet, the market is rewarding upside earnings surprises less than average and punishing downside earnings surprises more than average.

For all of 2018, analysts are projecting earnings growth of 19.5% and revenue growth of 7.2%.

Forward P/E Ratio is 16x – it was 16.4x at the beginning of the year. The 5-year average is 16.1x and the 10-Year average is 14.3x.