McCormick (MKC) delivered Q3 adjusted EPS of $1.12, an 8.7% increase from last year, and above consensus expectation of $1.03. Better yet, MKC raised guidance range from $4.05-$4.13 to $4.20-$4.24. The bottom of the new range is above all street estimates. The acquisition of Reckitt Benckiser’s (Frank’s hot sauce) has been more accretive than expected. MKC is up 5% on the positive news. Continue reading “McCormick Strong Results Q3 2017”

Research Blog – INTERNAL USE ONLY

Black Knight Spin-off

Black Knight Financial Services spin-off from Fidelity National (FNF)

Price: $43.45 P/E FY1: 31.6 No Dividend Continue reading “Black Knight Spin-off”

Global Macro – earnings rally

An interesting slide deals with the continuing global equity rally. While there is merited concern about equity valuations, it is important to note that much of the run-up has been backed by earnings growth dating back to the end of 2015. We are now in the most synchronous global economic recovery since the financial crisis. Continue reading “Global Macro – earnings rally”

SSGA Chart Pack – Looking at Equity Factors

SSGA SPDR ETFs Monthly Chart Pack – September 2017

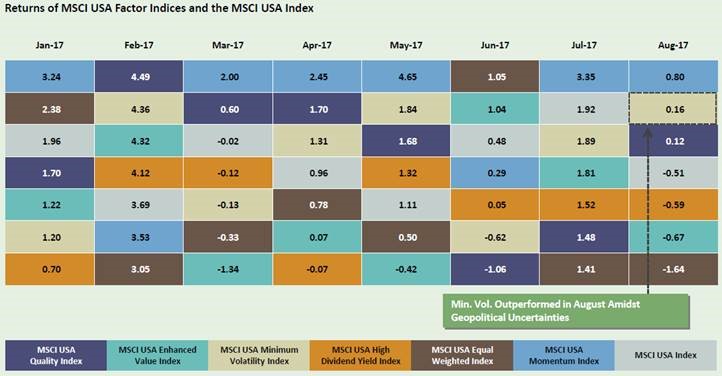

Attached is the September chart pack from SSGA. Below is one slide that shows monthly performance of the various equity factors in the U.S. YTD.

While this is a relatively short time period, it is a good example of why it makes sense to own more than one factor ETF. During the year, momentum (growth) performance has picked up while quality and minimum volatility have lagged on a relative basis. However, in August, we saw a spike in market volatility due mostly to geopolitical concerns.

This was the first spike that we have seen in some time. Minimum volatility held its ground with positive absolute and relative performance during the month, and importantly, acted in the way we would expect (outperforming during periods of uncertainty).

For clients that may ask why they own multiple equity ETFs (growth, quality, low volatility) this is just one simple example of how different factors balance one another out while reducing the overall risk of the portfolio.

“Wake me up when September ends” 9/7/17

September is considered the worst month for stock returns. The average return for the S&P 500 index for September is -0.7% (Since 1950). Additionally, recent negative news could affect stocks – Hurricanes Harvey and Irma, debt limit talks (delayed until December), North Korea nuclear tests and more Washington gridlock. The strong stock market optimism from the beginning of this year has faded pulled back. Finally, stock market valuations are above average, so what goes up must come down, right? Continue reading ““Wake me up when September ends” 9/7/17″

A discussion of “Liquid Alternative” Investments

Throughout financial history, every bull market seems to be characterized by some new investment product or vehicle that captures investors’ fancy. Like housing bonds in the early 2000’s, mutual funds in the 1980’s, and junk bonds in the 1970’s, liquid alternative assets appear to be that vehicle of the current bull market. Continue reading “A discussion of “Liquid Alternative” Investments”

Trump’s Impact on Investment Markets

Yesterday’s unexpected election result causes investors to wonder what can be expected over the next few years from a Trump presidency and a divided country. This election has been highly emotional and personal, leaving many of us bleary-eyed and uncertain about the future. The high level of emotion in this election is reflected in global stock markets, which initially sold off on Wednesday following Trump’s victory only to recover strongly as the day progressed. At Crestwood we know that emotions and investing don’t mix well. We try to look past the rhetoric to analyze potential long term outcomes of the election. Continue reading “Trump’s Impact on Investment Markets”

Implications of Populism

Why the anger? It’s the economy

One of the many notable characteristics of this unconventional presidential race is the broad-base populist uprising from both the left and right. Across the U.S., pockets of workers are fed up with dead-end jobs and stagnant wages. This anti-trade theme has resonated across both parties and will likely force changes in government policy, no matter who wins the election. Continue reading “Implications of Populism”

Investing Through Recessions

The U.S. economy has now grown for 69 straight months, making this the sixth-longest period of economic expansion since the 1850s. The stock market has climbed apace—albeit with plenty of volatility along the way.

Still, the law of gravity hasn’t been repealed. Economic growth and contraction have always alternated, and at some point we’ll experience a recession. That, of course, will impact stocks. Continue reading “Investing Through Recessions”

Quality Bonds: an Underappreciated Role in Portfolios

Stock markets across the globe fell sharply during the first few weeks of 2016. After years of strong stock market performance, downturns like these remind investors of the importance of diversification and disciplined portfolio construction. Even though interest rates remain near historic lows, bonds remain an important part of this diversification as adding them to portfolios lowers volatility (i.e. risk). Historically, high quality bonds, that is those with lesser credit risk, proved an important source of diversification during periods of equity market stress, offering lower correlation while their lower quality brethren tend to have returns more highly correlated to stock market returns. Lower quality bonds imply greater credit risk, which is the risk of not getting paid because the issuer goes bankrupt. Continue reading “Quality Bonds: an Underappreciated Role in Portfolios”