Yesterday Apple held an event introducing their latest devices. A few big takeaways…

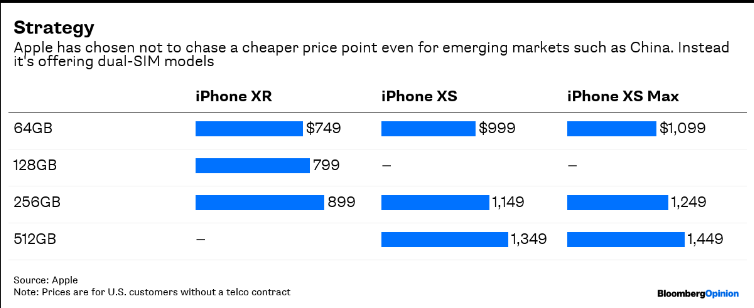

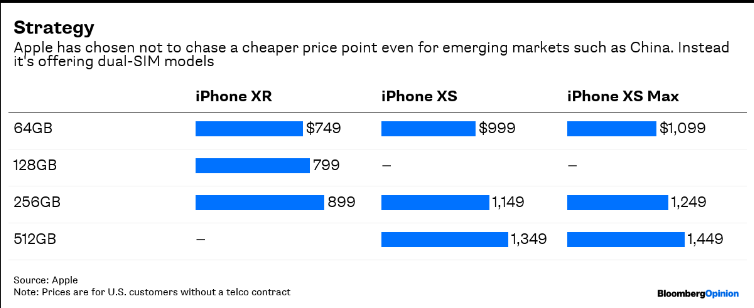

1. Higher iPhone price points and a wider price point range.

a. They have 3 new phones – will range in price from $749-$1449. XR, XS and XS Max. iPhone 7 price dropped to $449.

b. The iPhone XS Max – most expensive of the 3 (starts at $1099) and largest (6.5”)

c. Overall this should help ASPs – this is key because ASPs are driving their growth right now as units are flattish.

d. There’s some concern the cheapest of the 3 new models might be gross margin dilutive. Changes are evolutionary, but I think likely to drive enough uptake of more expensive models to offset any margin dilution from cheaper ones.

e. Way more memory. Most expensive XS models will have over half a terabyte of memory. That’s enough for 200k photos.

f. A12 Bionic Chip – “the smartest, most powerful chip ever in a smartphone.”

i. Industry’s 1st 7nm chip (Huawei has a 7nm chip announced too, but Apple’s ships first)

ii. Up to 50% faster than the A11.

iii. Enables more powerful apps…like augmented reality gaming.

g. All use face ID, no home buttons.

h. Waterproof to 2 meters, up to 30 minutes.

i. Camera is again improved.

2. New functionalities of the Apple Watch

a. Fall detection – if the watch detects a fall, it readies for a one-swipe 911 call. If you’re motionless for longer than a minute, it will automatically call 911 and send an alert to your emergency contact list.

b. New heart monitoring capabilities – can detect atrial fibrillation and perform an electrocardiogram. The president of the American Heart Association got on stage and said capturing meaningful real time data this way “will change the way medicine is practiced.” FDA clearance has been received on this.

c. 30% larger display (40mm & 44mm). New price points: $279-$499

3. Dual SIM

a. Makes it possible to have 2 phone numbers on one phone.

b. This is expected to be in high demand in international markets, especially China.

c. Accomplished by adding an eSIM card – basically a virtual SIM instead of a physical one (some international markets are 2 physical SIMs).

d. eSIMs may increase carrier churn and lead to more plan deflation because they make switching carriers easier, leading to more price competition.

4. Sustainability Presentation

a. Apple’s head of Environmental and Social issues got on stage and talked about their initiatives with renewable energy and using recycled parts.

b. For example, the logic board is now made of recycled tin and the cover has glass that’s 32% bio-based plastic.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

image001.png@01D41F46.8B1A85D0“>

image001.png@01D41F46.8B1A85D0“>