We are selling Fidelity National Financial, FNF, from portfolios, which may take a few days to complete trades. On 2/6/20, FNF announced an acquisition of F&G holdings, symbol FG, an insurance company that sells annuities. We do not like this merger for two reasons: 1) FNF’s business of title insurance does well when interest rates fall as mortgage refinancings increase. This success is opposite of most finance companies who earn less on spread income when rates fall. The purchase of FG will dilute this counter interest rate property which has been attractive. 2) FG has some concerns primarily their investment portfolio is too aggressively invested in lower quality bonds. I am concerned that a disruption in the BBB debt market would impair this company’s balance sheet and ability to conduct business. The BBB debt market has seen significant growth through this market cycle and appears frothy. FNF stock has fallen -13% since announcing the merger.

Category: Equity Research

Berkshire Hathaway Q3 2019 earnings

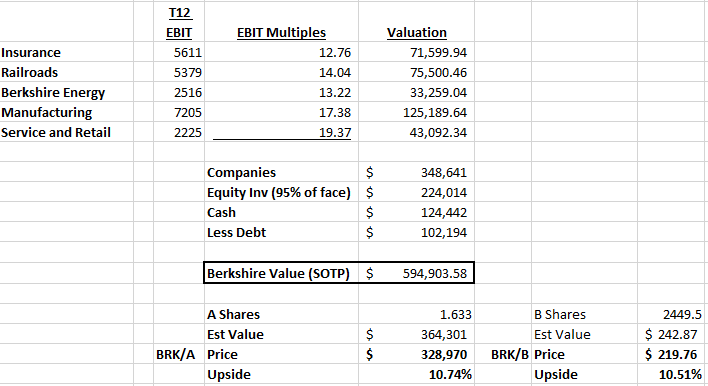

On 11/2/19, Berkshire Hathaway (BRK/A, BRK/B) reported Q3 earnings increase of 3.9% to $8.5b with strength in Insurance and Railroads. Sales increased 2.4% year over year. Berkshire’s collection of insurance companies and investments is unmatched and generates ~$8.8b in cash a quarter.

Current Price: $220 Price Target: $240 (raised from $225)

Position Size: 3.3% TTM Performance: 0.8%

Thesis Intact. Key takeaways from the quarter:

- Cash balances rose to hefty $128b or $50 a share for B class. BRK’s cash has risen from $60b in 2014. The high cash levels are a drag on earnings growth and have historically been criticized in the press. However, high cash levels are symbolic of Buffett’s patience as an investor and that market valuations are above average.

- Geico earnings rose, but saw similar profitability trends as Travelers with higher costs relating to severity of claims. Basically, the car insurance industry is paying more in liable claims which are dragging down profitability.

- Since 2018, headline earnings on BRK include unrealized gains on their equity portfolio. Before this mandated accounting change, gains were realized when positions were sold. When evaluating performance best to look at operational earnings which exclude the noise from changes in stock prices.

- Sum of the parts valuation is supportive of current price and suggests more upside, especially if excess cash is invested.

The Thesis on BRKB:

- Berkshire Hathaway has assembled an enviable portfolio of companies and investments that can compound book value per share in the mid-upper single digits.

- Negative cost of float gives it leverage to invest in stable companies that increases cashflow

- High cash levels put Berkshire in great position to deploy capital.

- Earnings from operating companies are stable and growing

- Berkshire is trading at an attractive valuation

Thanks,

John

$BRK/B.US

[tag BRK/B]

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Disney+ Initial subs better than expected

Disney is up after revealing that, since launching Disney+ yesterday, they already have 10m subscribers. This is far better than people expected…and positive news after the glitches the site has been reportedly suffering. Management said the technical issues were due to demand far exceeding their highest estimates.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$DIS.US

[tag DIS]

MSFT up on JEDI contract

Microsoft won a government contract for cloud computing services that is worth $10B over 10 years. The contract is for the Department of Defense and known as the JEDI contract (Joint Enterprise Defense Infrastructure). This has been in the news for a while as they were vying for the contract primarily with Amazon, who seemed favored to win. The contract itself is not a huge impact to MSFT’s numbers (given $140B in expected revenue in 2020 and the contract is for ~$1B/yr) – the more meaningful impact may be the win opening the potential for other government contracts. And in general it underscores the strength of Microsoft’s Azure cloud offering and its long-term potential. Some analysts are actually calling it a paradigm changer for Microsoft and a “landmark win that will change the cloud computing battle over the next decade.” Others think it is less meaningful given potential political interference in the bidding process and the possibility that Amazon may try to protest the outcome.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$MSFT.US

[tag MSFT]

Travelers Q3 earnings report

On 10/21/19, Travelers reported Q3 EPS of $1.43, well below consensus estimate of $2.34. Shares sold off ~8% on the earnings miss. Travelers missed earnings due to increases in reserves in their business segment due to higher than expected losses in asbestos claims and higher tort cost for general liability and auto. The rising costs appear to be an industry trend. In response business policy renewal rates have increased to 7.4% which Travelers expects will offset the higher cost trend and restore profitability. Travelers seems to be early/leading the industry with increases in reserves.

Travelers is a high quality, disciplined underwriter of insurance that is focused on returning capital to shareholders through dividends and share buybacks. Insurance earnings are historically volatile, so we are maintaining price target and weight, expecting that Travelers will return to its profitability trend.

Current Price: $131.43 Price Target: $155

Position Size: 2.16% TTM Performance: 10.9%

Thesis Intact. Key takeaways from the quarter:

- Higher losses on tort related expenses

· Generally, insurance companies record revenue in one period and hold reserves to pay for claims in future periods. If they reserve more than they pay out in claims, the excess reserves will be released as earnings. The reverse happened this quarter for Travelers as claim trends were higher than expected which required an increase reserves.

· Q3 saw adverse development in asbestos claims of $228mm, in general liability of $114 and commercial auto of $134 primarily due to inflation on tort related settlements.

- TRV continues to aggressively return capital to shareholders – for 2019 year to date TRV returned $1.8b to shareholders out of $1.8b in earnings

- Over past 10 year shares outstanding have fallen 53%!

- Shareholder yield of 7.1% = 2.5% dividend and 4.6% share buyback

- Management employing capital wisely! Instead of investing in mature business with spotty pricing, they are returning excess capital to shareholders

- Some positives in the quarter

- Importantly, Travelers is increasing prices significantly – up 7.4% – to offset higher costs of future claims

- Record net premiums of $7.569b up 7%

- Book value per share $99.21 up 14% from year end 2018

- Q3 ROE of 6.2% with YTD ROE of 9.6%

4. Valuation of 13 P/E is slightly above the median of its five-year valuation range of 10 – 15.

The Thesis on TRV:

- We expect TRV will be able to grow book value per share in the mid-single digits over the near-medium term, and generate ROE in the 10-14% range

- Industry leader with disciplined underwriting and investment portfolio track record

- Consistent returns in the low to mid double digits

- Responsible capital allocation and proven desire to act in the best interests of shareholders

Please let me know if you have any questions.

Thanks,

John

($TRV.US)

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Resmed (RMD) 1Q20 earnings results

Key Takeaways:

Current price: $127 Price target: $138

Position size: 2.96% 1-year performance: +28%

Resmed released impressive global masks sales growth of 19%, most likely grabbing additional market shares. Total sales were +16% (ex-FX), or +11% organic. The management team highlighted positive conditions in all its major markets in Q1 (new product launches, expansion of resupply programs), but we should expect some deceleration going forward, as competitors are launching new products as well, and year-over-year comparison numbers become harder to beat. Devices sales were +8% in the US, gaining market shares in this segment as well, as the digital connected care is gaining traction. Sales were up “only” 4% in the rest of the world, as RMD had tough comparisons y/y.

Gross margin expanded thanks to recent acquisitions, better product mix and some pricing. With strong sales, the company is seeing some nice operating leverage.

We believe the software business the company has been expanding this past few years will provide continued growth for the company, growing from high single digits in Q1 to double digits into fiscal year end.

Overall it was a pretty nice quarter for the company, supportive of our thesis on the name.

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Update on Alphabet

Yesterday 50 attorneys general from 48 states announced an investigation into anti-competitive practices at Google and Facebook – (includes DC and Puerto Rico, but not California and Alabama). The stock is not really reacting to the news. Among the concerns cited by the AG’s were the company raising costs for advertisers and questioning whether consumers are getting the best information from search results. This announcement comes after the DoJ has announced a broad review of Big Tech and is recently confirmed to be conducting an investigation of Alphabet. The FTC is investigating FB and is rumored to have plans to investigate Amazon. Below is a good excerpt from the WSJ outlining the potential case against Google. It’s not clear what the outcome may be. A required change to their business model would likely be more damaging than fines. Alphabet has been investigated by the FTC previously – in 2013 the commission voted unanimously not to bring any charges and determined that Google’s practices improved search results for the benefit of users and that any negative impact on competitors was “incidental to that purpose.” After lengthy investigations in the EU over the last few years Alphabet was fined over $9B (see below). To put that in perspective, Alphabet has over $100B in net cash on their balance sheet and produces $20-$30B in FCF annually.

Recent EU fines:

1. $1.7B in 2019 for illegal practices in search advertising aimed at cementing its dominant market position.

2. $5.1B in 2018 for abusing the market dominance of its Android operating system to extend the reach of Google’s search engine.

3. $2.7B billion in 2017 for abusing its market share to illegally provide an advantage to its own Shopping service.

The Potential Case Against Google

•That Google has used its dominance in online search to solidify its dominance in internet advertising, creating an unfair advantage over publishers and rival tech firms that sell and place ads online. Google, thanks in part to acquisitions of potential rivals such as DoubleClick, has come to dominate software tools at every layer between online advertisers and websites, including the main tech platform that connects buyers and sellers of display ads, this argument goes. That middleman status has given it great power, especially because no one else has anything like the data Google possesses on publishers, advertisers and what consumers search for. Advertisers are boosting their spending on digital ads, but much of the money goes to Google and Facebook, not publishers, whose ad revenues continue to decline. (News Corp, publisher of The Wall Street Journal, is among those raising objections.)

•That Google won or maintained its huge market share of online ad sales by excluding others that could have competed, including through contractual terms that make it harder for advertisers and publishers to work with other ad businesses that want to compete with Google. Advertisers feel they must use Google’s products, rather than tools from other companies, according to this argument. And in 2016, Google began requiring that advertisers use its tools to buy ads on its YouTube channel, which has by far the biggest audience for online videos.

Google’s Defense

•Google has an enviable place in online advertising, but it doesn’t have monopolistic pricing power. Google competes with other big tech companies including Facebook and Amazon for ad dollars, and weak demand for old advertising models—not its role in the ad-tech machinery—is the reason publishers haven’t reaped more of a windfall from digital ads.

•Google’s actions are geared toward goals like giving users the information they want, as quickly as possible. Sometimes that means directing consumers to Google sites and services, the company says. Supreme Court precedent states that companies such as Google generally have no duty to assist in promoting a rival. In a 2004 ruling, the high court threw out antitrust allegations that Verizon Communications Inc. provided insufficient service to rival telecom companies using its phone lines.

•Many of Google’s services are free to the public, with consumers effectively paying with the personal data they generate. Judges may face challenges assessing the nontraditional products that companies like Google and Facebook offer. “It’s not like having 90% of the market for toothpaste,” said Cleveland State University law professor Christopher Sagers.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$GOOGL.US

[tag GOOGL]

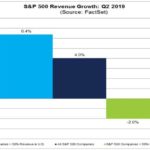

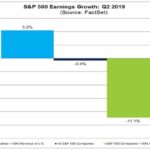

Update on Q2 Earnings results…

Summary of Q2 earnings results for the S&P:

· Q2 EPS growth was -0.4% – this is better than the -2.7% expected.

· Revenue growth for Q2 was 4%. This is better than the 3.8% growth expected.

· Margins are down 50bps YoY for the S&P.

· Companies with higher international exposure are seeing lower growth because of strong dollar and weaker macro environment outside the US – see charts below.

· Percent of companies beating on revenue (56%) is well below average.

· % of companies issuing negative EPS guidance for Q3 is above average

· Highest earnings growth: health care and financials

· Biggest decline in earnings: materials and industrials. Within materials Metals & Mining earnings were down -76%. Within industrials Aerospace & Defense earnings were down -50%.

· Highest revenue growth: communication services and health care.

· Biggest revenue decline: materials.

· For CY 2019, analysts are projecting 1.5% earnings growth and 4.4% revenue growth.

· For CY 2020, analysts are projecting 10.7% earnings growth and 5.6% revenue growth.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

Update on CSCO

Couple of news items on Cisco…

1. There are reports that Cisco is cutting its workforce in China – the layoff is rumored to be mostly sales positions. CSCO has two offices in Shanghai, one for R&D and one for sales – the cut would reportedly not impact the R&D office. Cisco denied the rumor when contacted by The Global Times of China. China is about 3% of Cisco’s revenue. Cisco reports quarterly results on August 14.

2. Cisco settled an $8.6M lawsuit w/ a whistleblower over faulty video surveillance software – there were security flaws that permitted hacking of Cisco’s video surveillance software which Cisco sold to the military, multiple federal agencies, international airports, etc. The whistleblower identified the issues in 2008 and reported them to Cisco, but apparently Cisco did not alert customers until 2013 of "multiple security vulnerabilities " in the software. Cisco said, "there was no allegation or evidence that any unauthorized access to customers’ video occurred"…though video feeds could "theoretically have been subject to hacking."

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$CSCO.US

[tag CSCO]

TJX and AAPL down on new tariff announcement

TJX and AAPL down on new tariff announcement of 10% on another $300B in Chinese imports that would take effect Sept. 1. A draft list was published in May which included a long list of consumer and technology goods (including Apple’s major products). Retail/apparel names down big on the news. M, JWN, PVH, GPS, KSS, URBN all down 6-8%. As a reminder, in mid-June Apple’s Taiwanese manufacturing partner Hon Hai Precision (better known as Foxconn) told investors they have enough capacity outside of China to assemble iPhones for the US market. Most iPhone components are sourced outside of China but labor intensive assembly occurs within China. Apparently 25% of Foxconn’s production capacity is outside the mainland. This addresses concerns that Apple would need to either raise prices to offset potential tariffs or take a margin hit. Foxconn also indicated that investments are being made in India for Apple to expand production plants as a way to diversify the supply chain away from China.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$AAPL.US

[tag AAPL]

$TJX.US

[tag TJX]