· Yesterday the European Parliament passed the EU Copyright directive (see original email from Sept. below) which is primarily targeted at Google and Facebook.

· The directive includes 2 key articles – Article 11 (the ‘link tax’) and Article 13 (the ‘upload filter’). The Link Tax gives publishers the right to charge for linking to their content and the Upload Filter would put the obligation on platforms to identify what is copyrighted by making them liable for copyright infringement. Commercial deals with publishers would be required in order for Google to show hyperlinks and short snippets of news.

· Those in favor (content creators) say it protects their product, giving publishers a negotiating edge w/ Google and Facebook. Those against it say it limits the free access of the internet. Part of the concern is that the directive is vague and it’s difficult to precisely filter out what’s copyrighted and what’s not – the result may be over-blocking content in an effort to limit the risk of an infringement. The wording of the directive is apparently ambiguous enough that the impact it will have is not entirely clear and may become more clear in the future – countries may interpret the directive differently.

· User generated content on places like YouTube and Facebook would need to be filtered. Google already does this to an extent on YouTube.

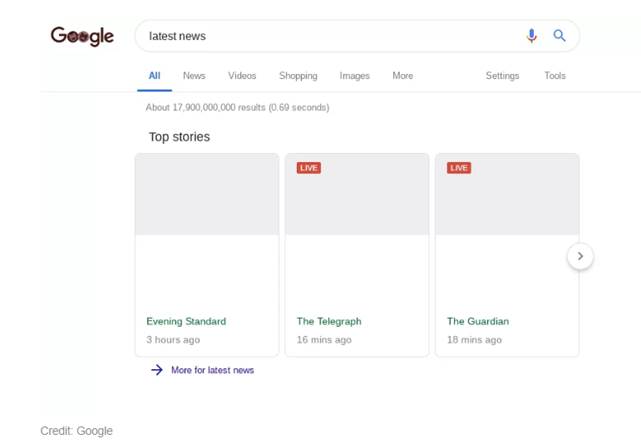

· Google News would need to license all the content that shows up in search results. Google put out the screen shot below of what News search results would look like without licensing.

· Google says “we built Google to provide everyone with equal access to information”…”Article 11 means that search engines, news aggregators, apps, and platforms would have to put commercial licenses in place, and make decisions about which content to include on the basis of those licensing agreements and which to leave out.” As a result, Article 11 would mean Google is picking winners and losers based on who they establish commercial agreements with (likely the largest publishers).

· The revenue impact to Google should be limited. EMEA is about 1/3 of revenue. Ad revenue from relevant news sites in Europe is a small subset of that. Importantly, these same publishers make money by traffic landing on their sites via Google by selling ad space through Google’s AdSense product. The larger consequence may be more around limiting news results.

$GOOGL.US

[tag GOOGL]

From: Sarah Kanwal

Sent: Friday, September 14, 2018 12:33 PM

To: ”

Cc: CrestwoodAdvisors <crestwoodadvisors>

Subject: EU Copyright Directive

· The EU is on a path to create copyright laws aimed at helping publishers of content (e.g. journalists, musicians etc.) get a bigger piece of ad revenues that go to companies like Google and Facebook.

· The EU parliament voted in favor of the directive a couple days ago, but there are several more steps for this to pass.

· The new rules would give publishers the right to ask for paid licenses when a platform shares their stories (i.e. Google News) or video clips. Some are calling it a “link tax." The rules would also put the obligation on platforms to identify what is copyrighted by making them liable for copyright infringement.

· The implications aren’t entirely clear yet. For example, the rules would apply to “commercial platforms” but it’s not clear whether that applies to blogs etc., which would widen the impact.

· Other countries like Spain and Germany tried similar rules in the past and they failed. Google’s response was either to shut down Google News or just remove any news sources that wouldn’t give it free access…which meant traffic to those sites collapsed.

· The regulation might actually reinforce the dominance of the strongest players. The cost burden of this regulation would be easier for large firms like Google to absorb as it would require firms to build technology to identify and filter copyrighted content. Thus it might have the unintended consequence of strengthening Google (and other platform giants) relative to smaller firms/startups. In fact, Google already largely complies with these rules on YouTube with their “Content ID” filter.

· Opponents also say that complying with these rules would limit the free access of information that the internet is designed to offer.

· If this directive keeps progressing their will likely be more vocal industry resistance, as many who have been critical of the big tech firms don’t support it. For example, Tim Berners-Lee (inventor of the world wide web), who has spoken widely about the risks of Google’s and Facebook’s dominance, is ardently against these potential regulations.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com