Cigna is acquiring ESRX for a 31% premium ($48.75 in cash and 0.2434 in stock). This deal validates the shift towards vertical integration in the healthcare space, as the different players try to resolve the continued pricing pressure and recent Amazon threat.

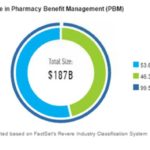

I believe standalone PBMs will disappear from the system, especially smaller PBMs that won’t be able to compete as well, although they only control 8% of the market currently.

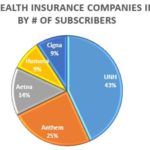

According to the Insurance Information Institute, there are 858 health insurance companies in the US, which leaves room for the major players to keep gaining shares. Major mergers have been blocked by the Justice Department (Anthem/Cigna and Aetna/Humana), but by integrating PBMs with their insurance operations, majors insurance companies will squeeze out smaller players as they will be able to negotiate better terms for their clients.

My assumptions is that the integrated PBM business will over time no longer grow from outside health insurance contract wins, but support the growth of their own insurance business (with a better margin and revenue growth profile in the mid-single-digit range).

What sets CVS/Aetna apart is its retail pharmacy network and growth potential in the MinuteClinics. UNH is now trying to replicate this MinuteClinic model by acquiring small clinics/urgent care centers, and recently made a bid for Envision (an ambulatory outpatient surgery center such as ophthalmology – FYI I tested it in Boston a couple years ago, it wasn’t that bad and very convenient).

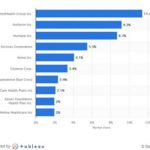

Health care Insurance companies market share (the left chart is a bit outdated, as it is from 2015):

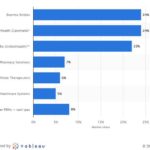

PBM Market shares (a bit outdated, as this is from 2016, and Express Scripts lost the Anthem business, representing 20% of their revenue):

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!