Thesis intact, key takeaways:

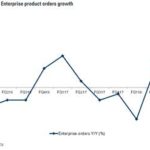

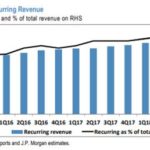

Cisco reported Q3 earnings and beat on the top and bottom line and guided in line with street. While the quarter was strong, the growth of Services revenue (26% of revs) seemed to be a little lower than expected and gross margins were lower. They had 70 bps of gross margin compression driven almost entirely by higher memory costs. This is similar to previous quarters and is an industry wide phenomenon. They continue to make good progress on their transformation from a hardware business to a software and services focused business. The percentage of recurring revenue is now at 32% – they set a goal of 37% by 2020. Enterprise saw accelerated growth at +11% YoY driven by strong growth with Catalyst 9k units –the 9k switches are only sold with a subscription and are a key part their strategy of shifting their core business to recurring revenue. They saw strength in both campus and data center switching. Additionally, Applications and Security were both strong – up +19% and 11% respectively. As expected, Service Provider revenue trends continue to be weak, pressuring router sales – though exposure to this end market is decreasing. They repurchased $6.2bn worth of shares in Q3 and still have $25B remaining in their buyback authorization which they aim to complete in 1.5-2yrs.

Valuation:

· They have 3% dividend yield which is easily covered by their FCF.

· FCF yield of over 6.5% is well above sector average and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!