Current Price: $106 Price Target: $120 (new target price; increased from $105)

Position size: 5% TTM Performance: 42%

Microsoft reported solid Q4 results beating on the top and bottom line and delivering above consensus guidance. Revenue growth accelerated slightly from 16% last quarter to +17%, with double digit revenue growth across all segments. Revenue was $30B for the quarter and for the year crossed $100B for the first time. Top line results were aided by the weaker dollar which added 2pts. Windows and the PC cycle still matter, but Cloud is the key driver of growth. They saw strong demand in both, driven by a robust IT spending environment. Though Microsoft has trailed AWS, Cloud adoption is moving into a phase where Microsoft should have an advantage. The results this quarter substantiate that. The key is hybrid cloud and multi-cloud. Early cloud adopters tended to be smaller companies and digital native companies – companies that didn’t have enormous legacy data centers with tons of money invested in equipment or with critical data that they wanted to keep in-house. As larger companies with legacy IT infrastructure increasingly shift to the cloud, they will take a hybrid approach, which just means they still keep some stuff on-premise. It is a bridge between the old and new. Microsoft has an advantage with Azure stack because it is a highly differentiated product and the leading technology for hybrid. They are also well positioned because they have entrenched enterprise relationships. The trend to multi-cloud refers to companies wanting to use multiple vendors so there is no vendor lock-in or loss of bargaining power. So, adopting AWS doesn’t mean you wouldn’t also use Azure. Microsoft is and will continue to be a beneficiary of this trend.

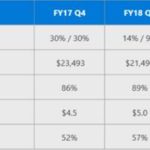

Commercial Cloud (Office 365 commercial, Azure, Dynamics 365) revenues were $6.9B, up 53% and accounting for 23% of revenue in the quarter (up slightly from 22% last quarter). For the full year, Commercial Cloud was $23.2 a little ahead of expectations and full year cloud run rate is now close to $28B. Importantly, cloud margins continue to improve (+600bps YoY) which will help drive better FCF margins as the business scales. Within Commercial Cloud, Azure grew 89%. The “More Personal Computing” segment which includes Windows, Xbox, Surface, and all other hardware continues to improve. That segment accelerated to 17% growth on solid results from Windows Commercial (+23%), Surface (+25%) and gaming (+39%). This segment performance is consistent with their previous comments of an improving commercial PC market and a “stabilizing” consumer PC market. Free cash flow in the quarter was over $7.4B down 15% YoY reflecting higher capex in support of their cloud business. Capex was $4B in the quarter vs $2.3B in 4Q17. They returned $5.3 billion to shareholders with $3.2B in dividends and $2.1B in share repurchases.

Valuation:

· They produced $32B in FCF for the year putting them at close to a 4% FCF yield – reasonable for a company with double digit top line growth, high ROIC and a high and improving FCF margins.

· They easily cover their 1.6% dividend, which they have been consistently growing.

· Strong balance sheet with about $134B in gross cash, and about $57.5B in net cash.

· Increasing price target to $120 based on ~30% FCF margins and mid-to-high single digit top line growth.

Investment Thesis:

· Industry Leader: Global monopoly in software that has a fast growing and underappreciated cloud business.

· Product cycle tailwinds: Windows 10 and transition to Cloud (subscription revenues).

· Huge improvements in operational efficiency in recent quarters providing a significant boost to margins which should continue to amplify bottom line growth.

· Return of Capital: High FCF generation and returning significant capital to shareholders via dividends and share repurchases.

$MSFT.US

[tag MSFT]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!