Current Price: $46 Target Price: $54

Position size: 4.4% TTM Performance: 30%

Thesis intact, key takeaways:

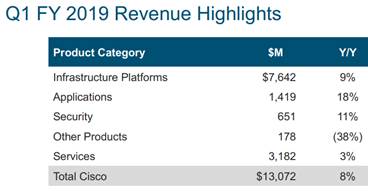

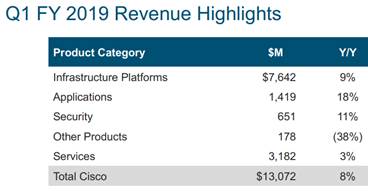

· Cisco reported a really solid Q1 with better than expected sales and EPS and issued guidance in-line with consensus. Top line growth was ~8%. FY19 sales growth is expected to be +5-7% and GM guided better than expected.

· Impact of the 10% tariff was immaterial in the quarter. They were able to offset with pricing. Their guidance assumes some impact from the tariff escalation to a 25%.

· The transformation they laid out 3 years ago is working, driven by their transition to a software and services focused business. They accelerated revenue growth, expanded margins, generated strong operating cash flow and double-digit EPS growth.

· Growth was broad-based across all geographies, product categories, and customer segments.

· The percentage of recurring revenue is now ~1/3 – they set a goal of 37% by 2020.

· Gross margins increased by 110bps YoY mostly driven by Product gross margins, while Service margins where basically flat.

· Switching had another great quarter and routing returned to growth.

· Campus switching strength – Infrastructure Platforms segment (58% of revenue; +7% YoY) driven solid demand for their Catalyst 9k products. Catalyst 9K was launched last year and is only sold with a subscription. The product is a key part of their strategy of shifting to recurring revenue. It involves “intent-based networking” – this automates configuration, saving labor hours. The reason it’s relevant and resonates with customers is because networks are becoming more complex. Enterprises are expanding to multi-cloud and hybrid-cloud environments with growing data traffic from a proliferation of new devices.

· They have $43B in cash. In the quarter they returned $6.5B to shareholders through dividends and buybacks.

Valuation:

· They have close to 3% dividend yield which is easily covered by their FCF.

· Forward FCF yield is over 7%, well above sector average and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on a hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!