Key Takeaways:

Current Price: $90.8 Price Target: $102

Position size: 2.51% 1-Year Performance: -5%

- Organic sales growth of 20%, driven by both segments, a big beat from consensus expectations

- Consumer segment up 32% y/y ex-FX

- Flavor Solutions +3.4% y/y ex-FX

- Capacity constraints are easing from FY20, shipment timing helped this quarter’s performance, as MKC is rebuilding its inventory level with retailers

- Increased cooking at home and demand from packaged food manufacturer is offsetting weak restaurant/foodservice providers

- Fundamentals remain healthy

- Margin improvement from operating leverage, favorable mix and cost savings

- ERP spending was put on hold last year, and it hasn’t resumed to its full extent yet (ramp up in spending could come in 2Q)

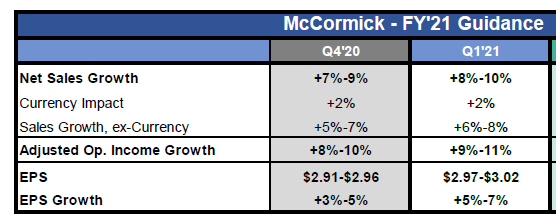

- FY2021 top and bottom-line guidance raised following a good Q1

Yesterday released its earnings for 1Q 21. McCormick had (yet again!) another impressive sales growth this quarter. In the Americas Consumer segment (its biggest in sales), its US branded portfolio grew 15% thanks to repeat purchases and household penetration increase, while the foodservice and restaurant demand declined. In the EMEA region, there was broad based growth due to the same dynamic as in the Americas in Consumers, but restaurant demand declined. In the Asia Pacific region, quick service restaurant, branded foodservice and consumer demand is recovering with double-digit growth. For this coming fiscal year, sales should grow 8% to 10%, with 2% benefit from currency and 3-4% coming from recent acquisitions. Prices increases will be done in 2021 if needed, a good indication of pricing power/leadership. Overall we are please with MKC and the thesis remains in place.

The Thesis on MKC:

- Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

- Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

- Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

- Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$US.MKC

[tag MKC]

[category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109