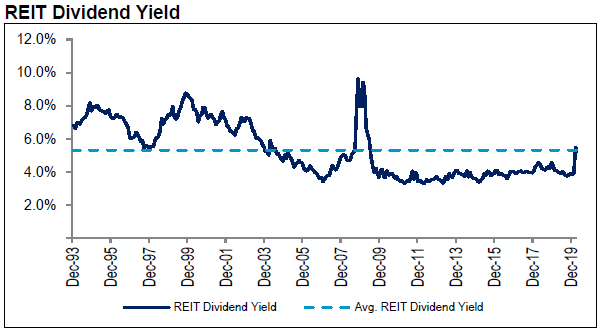

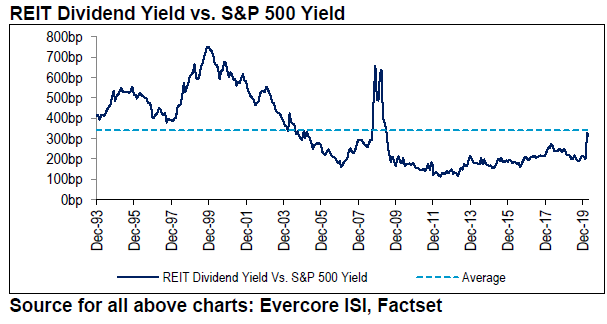

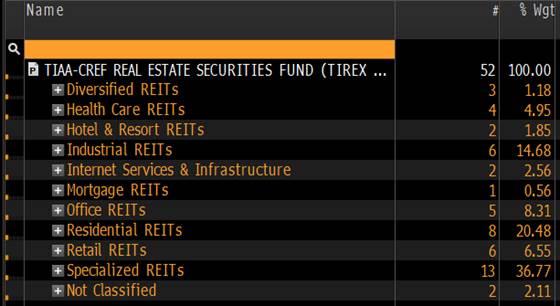

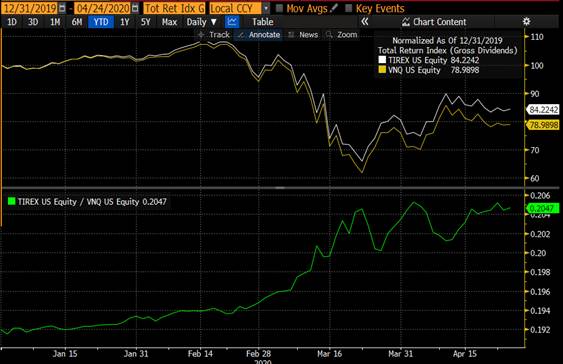

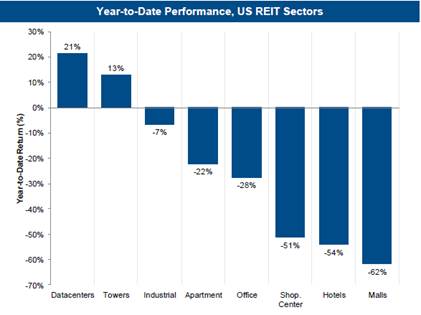

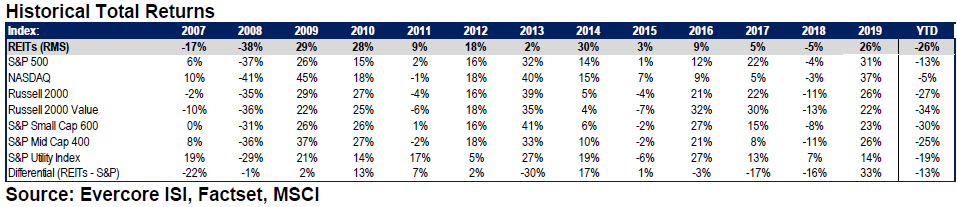

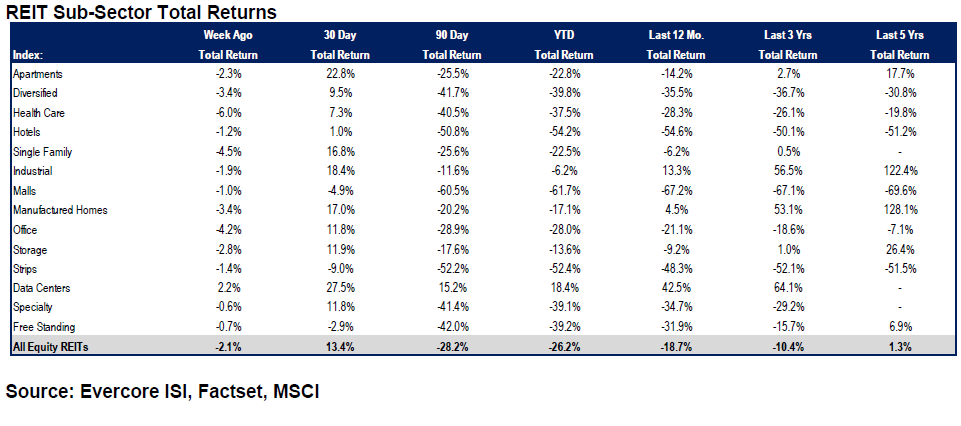

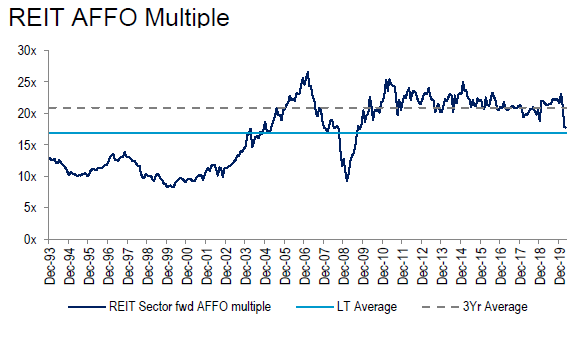

We wanted to give some insights into REITs and the changing landscape within this asset class – which has gone from a focus in retail REITs to specialty REITs through this downturn. We wanted to point out that while REITs have been hit YTD, the asset class is not overvalued and pays a strong dividend. Additionally, by investing in funds such as TIREX (TIAA-CREF’s REIT Fund), we are able to take advantage of this changing landscape and produce excess returns through exposure to strong performing REIT sectors.

Please see the graphs (and notes) provided below and the Excel attachment. Within the Excel sheet, the first tab displays the shift in weights within the REIT Index (using VNQ). The second tab will show the historical returns and current yields of each REIT sector.

Specialized REITs have been a fast growing part of the REIT index and include the two top performing REIT sectors: Datacenters and Towers.

AFFO: Adjusted Funds From Operations – measure of financial performance of REITs