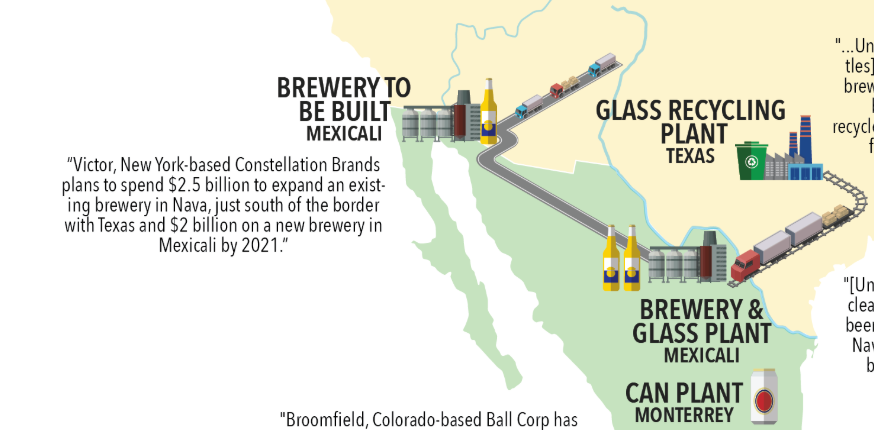

Yesterday Constellation Brands announced a partial shut-down of its beer production plant in Mexico, a less drastic move than peers that have completely shut down their plants in the region. STZ is complying with the government’s order to shut down non-essential activities, but wishes to safeguards its environment and avoid irreversible damages to its operations. Ahead of the shut-down the company had accelerated its production of high-volume SKUs. On the bright side, STZ has nearly 70 days of finished goods on hand with 80% already on the US soil. Per the management team, this is enough to avoid near-term service disruption. As for the expansion plans derailment (recent vote by locals to stop the plant construction), STZ continues to have a dialogue with the Mexican government regarding its Mexicali plant and finding a satisfying solution. We believe STZ should be able to recover some of the money lost in the construction of the plant, as the Mexican government would not want to send the wrong message to other foreign companies about future projects in the country.

Regarding the latest quarter’s results, STZ performed better than expectations, with beer sales +8.9% (led by Modelo and Corona). Modelo Especial is now the #4 beer brand in the US. The introduction of their newest innovation (hard seltzer) is going well. There is no current guidance for FY21 as the macro environment continues to evolve with the COVID-19 lock-downs. But sales for at-home consumption are high (+24% in the 4 weeks ended 03/22).

We remain positive on the long-term story of this company.

Investment Thesis:

· Adding STZ helps position our portfolio to be more defensive at this stage of the economic cycle

· STZ is down ~20% YTD, giving us a good entry point

· STZ continues to have HSD top line growth and high margins that should incrementally improve going forward

· STZ comes out of a heavy capex investment cycle to support its growth: FCF margins are set to inflect thanks to lower capex

[tag STZ] [category earnings]

$STZ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109