As virus concerns create fears of a weakening dollar, investors flock to Gold, which has historically given a source of safety and positive returns during market volatility and drops. Yet, even with this recent spur in the value of Gold, we do not see Gold as a necessary investment in our portfolio due to:

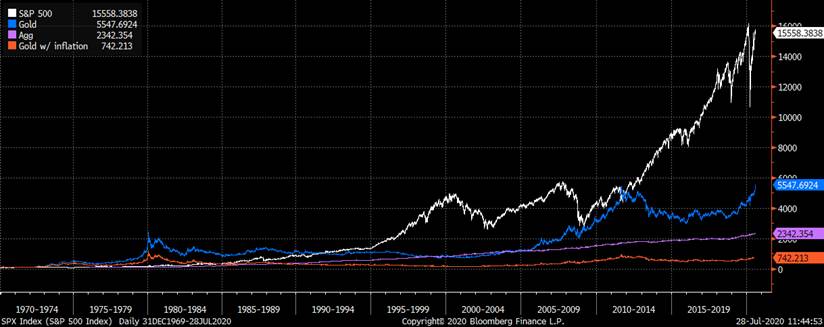

1) Similar volatility to the S&P 500, yet lagging relative returns over the long-term;

2) No earnings growth;

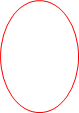

3) Allocating to bonds provide better portfolio diversification, risk reduction, and a steady source of income;

4) No valuation method;

5) Low correlation between Gold and inflation over long run.

Case For Gold

Gold has been an asset class that investors look towards as equity returns weaken and fears of a weakening dollar grow. Due to its close-to-zero correlation with other investment vehicles (equities, bonds, etc…) and historically strong returns during a bear market, Gold has been a way for investors to diversify their portfolio while achieving better than market returns during tough times. If bought and sold on the right dates Gold can even be a better performer than the S&P 500! Lastly, it is worth mentioning that monetary debasement fears have helped boost Gold’s growth, especially in recent times.

Case Against Gold

While Gold provides diversification and strong returns during market uncertainty, and has seen an increase in value recently, we do not believe Gold is an asset class worth allocating to in our portfolio.

1) Similar volatility to the S&P 500, yet lagging returns over the long-term

2) No earnings growth

A concern with allocating to Gold is its lack of financial data. Gold does not have any revenue or earnings to track and project, leaving no way of forecasting the type of growth Gold may have, and ultimately valuing the asset type. On the other hand, equities (stock in particular) do provide this type of analysis allowing us to build different modelling styles to further understand the asset class.

When we look the daily 10-year volatility of Gold (Gold Spot price) against the S&P 500, we see how similar the numbers are (and how much more volatile Gold is compared to the Agg).

|

|

Daily 10 Year Volatility – Annualized |

|

S&P 500 |

17.52% |

|

Gold |

15.57% |

|

Agg |

3.42% |

And even though Gold has some periods of outperformance, over the long-term Gold drastically underperforms the S&P 500 (especially when accounting for inflation).

|

|

YTD Return |

3 Year Return |

5 Year Return |

10 Year Return |

25 Year Return |

|

S&P 500 |

1.27% |

53.72% |

75.92% |

260.82% |

1051.53% |

|

Gold |

28.81% |

68.58% |

64.95% |

78.14% |

410.20% |

|

Gold (w/ inflation) |

17.94% |

45.02% |

38.12% |

37.19% |

171.36% |

|

Agg |

7.33% |

20.86% |

24.71% |

55.03% |

316.22% |

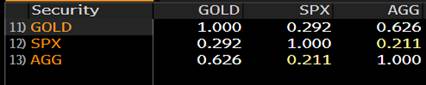

3) Allocating to bonds provide better portfolio diversification, risk reduction, and a steady source of income

If minimizing risk is the concern of a portfolio, bonds provide better diversification to equities compared to Gold. In addition to this, fixed income provides a steady source of income, even when yields are on the rise and are underperforming equities.

|

Monthly 25 Year Correlation

|

Weekly 3 Year Correlation

4) No valuation method

Gold does not pay a dividend, has no free cash flow, and has no true comparable assets, which makes the asset difficult to intrinsically value. The price and growth is highly dependent on the laws of supply and demand. For the value of Gold to grow, the “next” person needs to be willing to pay more for it than the “previous” person. This lack of fundamental analysis provides little direction as to when and for how long Gold should be allocated to.

5) Low correlation between Gold and inflation over long run

The debasement of the dollar has seemed to be a reason for large inflows to Gold in recent times, yet when we look at the correlation between inflation (ie. weakening dollar, increasing CPI) and Gold over a longer time horizon, we find close to no relationship (correlation value of 3.9% over a 20 year period). With such a low correlation, we would turn our attention to different investments that more directly protect against inflation (ie. TIPS).

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109