LISIX – Q1 2019 Commentary

The Lazard International Strategic Equity Fund outperformed the MSCIA EAFE Index in the first quarter by 150 bps driven by stock selection across most sectors. While political issues such as Brexit and trade can cause some market uncertainty, the team believes that market growth can be maintained given a more lax outlook in global monetary policy.

Market Overview:

– International equities rebounded strongly in the first quarter after weak end to 2018

o This was buoyed mostly by confirmation of the dramatic reversal in tone from the Fed

– Some signs of progress in US/China trade talks were also helpful

o Accompanied by early signs of stability in China after a variety of government stimulus

– With a combination of easing economic fears, and potential peak in rates, gains were broad based as both cyclical areas such as materials and more stable operations

– Technology sector saw jumps in both the cyclical semiconductor space and in long duration growth stocks

o Financials lagged, however, dogged by poor results, Scandinavian money laundering scandal and falling rate expectations

Performance Overview:

– Lazard International Strategic Equity portfolio outperformed the MSCI EAFE Index in the quarter

o Driven by stock selection across a number of sectors, mostly stemming from encouraging earnings reports

– In the industrials sectors, lock maker Assa Abloy and pilot training company CAE all showed good progress

o Chinese commerce giant Alibaba reported reassuring numbers, as did both Chinese insurer Ping An and its bank subsidiary

o Media stock Vivendi saw strong sales and rising bid speculation for its music business

– On the negative side, Spanish utility Red Electra was hurt by political uncertainty and a surprising satellite acquisition

– Japanese real estate company Daiwa House succumbed to sector weakness

– In the Philippines, conglomerate GT Capital is still seeing pressure on sales and margins at its Toyota auto business

Market Outlook:

– On the macro side, China is showing some signs of stabilization from its credit and sentiment slowdown, though Europe slowed further

– U.S. economic data was mixed with the labor market strong but forward looking indicators slowing

o Rising rates and cooling global growth started to bite

– Company reports have focused on weakening economy and cost pressures in many markets

– China has announced a variety of small stimulus measures, but the major change of tone came from the Fed, who went from increasing rates to possible decreasing

o The extent of this change was surprising given the amount of debt that has continued to pile up on public and private balance sheets

– Political issues such as Brexit and the trade war remain concerns but the market appears prepared to shrug off slowing growth again as monetary policy headwinds fade

– Overall, the team remains confident that by focusing on stock selection of sustainably high growth the long term track record can maintain

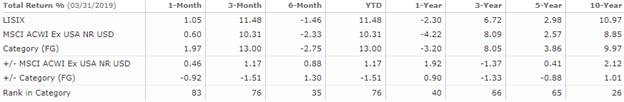

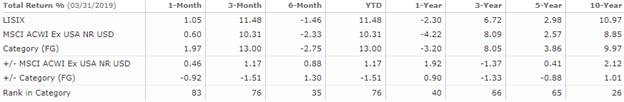

Performance Review:

[Mutual Fund Commentary}

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com