Author: John Ingram

Goldman Sachs Sale Recommendation

As discussed today, we are selling Goldman Sachs (GS). Goldman is reliant on trading results which have been lackluster over the past 6 years. Fundamentally, regulation has changed the brokerage business model, reducing opportunity for revenue and crimping margins. Weakness in hedge fund trading has hurt GS results relative to their peers. Given MiFID in Europe, we do not believe these headwinds will likely increase. Attached is our presentation with an updated slide on valuation which is at or near a 4-year high. goldman review 101917 RM

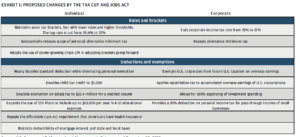

Overview of 2017 Tax Cut and Jobs Act

JP Morgan has published a very good bulletin summarizing the effects of the tax cut recently passed in Washington, which is attached. This article does a good job digesting the many changes and their effects on the economy.

Adding Black Knight, Inc. (BKI) to the Focus Equity portfolio

Black Knight, Inc. is a leading provider of mortgage processing and technology solutions to the US mortgage industry. Over 60% of all first lien loans are processed using BKI’s technology. BKI servicing revenue is very stable with long term contracts. Also, BKI sells software facilitating loan originations and sells data and analytics services to the mortgage industry. Continue reading “Adding Black Knight, Inc. (BKI) to the Focus Equity portfolio”

Bitcoin overview

The technology behind Bitcoin, Blockchain, is fascinating and a game changer. Blockchain is a way to assign value electronically. Whether it is cash, oil, electricity, stocks, bonds or even votes, the Blockchain technology is a safe and secure way to conduct transactions. Another way to think of Blockchain is a community where everyone agrees to rules setup in the code. Users are free to join or leave. There is no central authority, only the rules set forth by the code. Blockchain creates a history of all transactions which all the users agree is correct. Without digging into the technology, it is very difficult for one party to defraud everyone else. Continue reading “Bitcoin overview”

Aramark (ARMK) Q4 Results

Aramark (ARMK) reported Q4 2017 earnings of $.54 up 9% y/y. Sales were up 2% organically, missing analysts’ expectations of 3%+. Hurricanes dragged down results, especially uniform operations in Puerto Rico. Dividend was increased modestly. Price Target unchanged at $43. Continue reading “Aramark (ARMK) Q4 Results”

Fairfax (FRFHF) Q3 2017 Results

Fairfax’s Q3 2017 operating earnings of $16.42 were slightly below street expectations of $16.74 due to general softness in insurance underwriting and weak investment results. Despite these issues, results were solid with combined ratio of 91.6% (excluding storm losses), improving year over year from 94.5%. Including storm losses of $791m (after taxes), Fairfax still made a profit of $476.9m. Book value grew 15.4% YoY before investment results, mainly due to the acquisition of Allied completed earlier this year. Continue reading “Fairfax (FRFHF) Q3 2017 Results”

CVS Health Q3 2017 Results

CVS reported 3Q17 adjusted EPS of $1.50, above $1.49 consensus. Management raised guidance for 2017 to $5.87-$5.91 from $5.83-$5.93. For Q3 net revenues increased 3.5% driven by 8.1% sales gains in PBM business. Hurricanes disrupted retail operations – sales were down -2.7 and same store sales growth was negative -3.2%, which has put the stock under pressure today -$2.4. Continue reading “CVS Health Q3 2017 Results”

Berkshire Hathaway (BRK/B) q3 2017 Results

On Friday, Berkshire Hathaway (BRK/B) reported Q3 earning $1.40 versus consensus of $1.56. The gap was driven by hurricane losses of $3b or only 1% of book value which is impressive given the severity of losses for the season. Book value grew by 8.9% y/y, with shareholder equity totaling $311.8m and BRK/B holds over $65Bn of cash. BRK/B’s collection of high quality businesses continue to generate significant cash flow. Price target raised to $200. Continue reading “Berkshire Hathaway (BRK/B) q3 2017 Results”

Sherwin-Williams (SHW) Q3 2017 results

Sherwin-Williams (SHW) reported Q3 2017 results of $4.75, excluding one-time charges relating to the acquisition of Valspar. Results were ahead of street estimate of $4.68. SHW had strong same store growth of 5.2% driven by growth in sales and pricing. Lots of moving parts in the quarter given the Valspar merger, reordering of business into new segments and impact of hurricanes (-$.49 ). Overall organic growth was strong up 4.6%. Continue reading “Sherwin-Williams (SHW) Q3 2017 results”