As a firm, we do our best to keep our clients invested over time. It is extremely difficult to time the markets, and very often some of the worst days, weeks, or months, are followed by the best return periods (or vice versa).

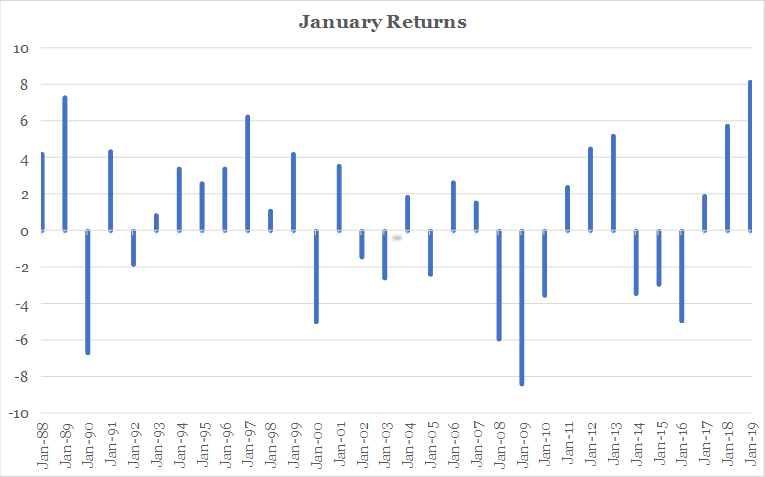

While I wouldn’t necessarily lead with this to clients, especially after the unease of a choppy year end, I want to point out that we just experienced a type of “bounce back” event. After experiencing the largest one month selloff since February 2009 (-9.0%) in December, the S&P 500 followed up with its highest returning January (+8.2%) since before I was born (30+ years).

That is not to say we expect markets to continue with this momentum. More to the point, it is a reminder that, by selling during periods of volatility, it is possible that investors can miss out on returns that are not easy to get back.

Another little side note, if we were to “extend” the 2018 calendar year one extra month (12/31/17 – 1/31/19), the S&P 500 is up 3.3%. I understand this isn’t the total return we have become accustomed to with U.S. equities, but it gives a sense that, if you didn’t react at all to the volatility of the last 13 months, your investment in the S&P has provided you with a positive total return.

Below is a chart of January Monthly Returns dating back to 1988:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109