Stock markets have continued to fall, erasing YTD gains. As with our 10/11/18 client blast (part of which is pasted below), there is no one overriding source of concern driving the selling. Highlighting this randomness is Marketwatch who offers a list of no fewer than 20 potential market ailments – click here. We believe that rising rates, trade negotiations and slowing global growth top the concerns, but see no need to stoke fear trying to capture every imaginable concern. Certainly, as the Federal Reserve withdrawals liquidity from the economy volatility has increased to more historical levels. As discussed in our last note, the US economy is still on solid footing and we remain committed to investing for the long term.

Perhaps a few reminders on Crestwood’s portfolio construction will help clients. We have built our portfolios considering the effects of both market downturns and upturns:

· Crestwood equities focus on quality stocks (or funds owning high quality stocks) with high returns on invested capital which we expect to outperform through a market cycle. This statement does not mean that every time stocks go down we outperform. In fact, the Focus Equity list has underperformed this week. However, we do expect our stock selection process to add value over time on the downside.

· Our fixed income portfolio focuses on quality bonds, which tend to perform well when stocks fall. In the beginning of last year, we reduced floating rate notes due to their exposure to credit risks.

· We own alternatives investments which diversify the portfolio and serve to reduce risk. Obviously, AQR has notably underperformed this quarter, but REITs have outperformed (QTD down -3.0% versus S&P 500 down -7.2%). We believe that the alternatives through a market cycle will provide added diversification, enhancing returns, should stocks lag.

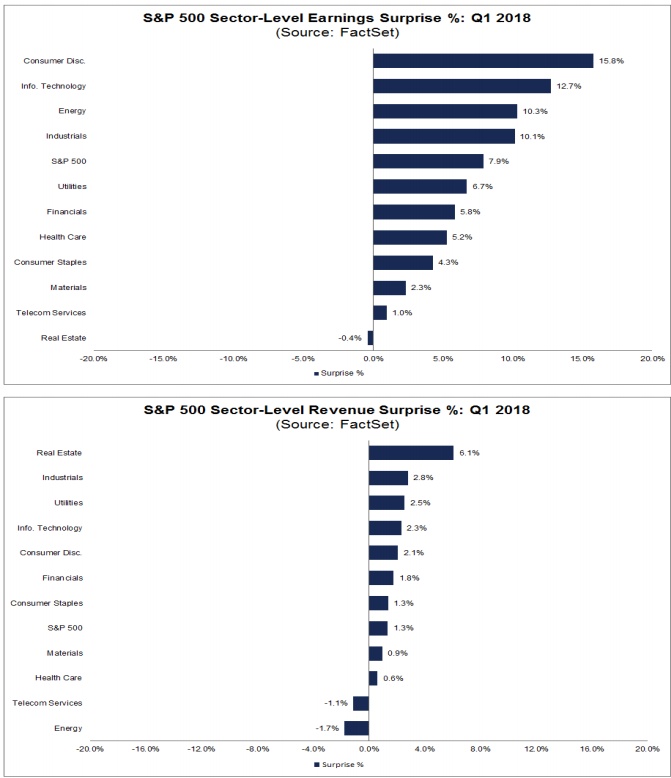

If clients are nervous about the current quarter of earning releases, here are some points from the end of last week showing how strong results have been:

· Earnings Growth: For Q3 2018, the blended earnings growth rate for the S&P 500 is 19.5%. If 19.5% is the actual growth rate for the quarter, it will tie the mark for the third highest earnings growth since Q1 2011 (also 19.5%).

· Earnings Scorecard: For Q3 2018 (with 17% of the companies in the S&P 500 reporting actual results for the quarter), 80% of S&P 500 companies have reported a positive EPS surprise and 64% have reported a positive sales surprise.

· Valuation: The forward 12-month P/E ratio for the S&P 500 is 15.9. This P/E ratio is below the 5-year average (16.3) but above the 10-year average (14.5).

Hopefully these points help your communications with clients.

Thanks,

John

Client blast from 10/11/18:

We can’t predict the markets or investor behavior, but fundamentals remain sound. Importantly, the U.S. economy remains on a healthy growth track. A driving force in the current jump in GDP growth has been the tax cut stimulus which is expected to continue until the middle of next year. Valuations are modestly elevated but have improved meaningfully this year with earnings growth averaging over 20%. The Federal Reserve continues to gradually increase short-term interest rates. With Federal Funds at 2.00%-2.25%, the Federal Reserve have moved monetary policy from ‘accommodative’ to ‘neutral’, but remains far from restricting economic growth. Inflation throughout this recovery has been stubbornly low with the latest CPI of only 2.3%. There is little need for the Federal Reserve to hike rates aggressively, and the Federal Reserve has been very clear in their intent to move cautiously. We view these rate increases as a return to normal rather than a threat to growth.

Volatility is normal. Each year the markets have some decline that averages 13.8%. Below is a chart that indicates largest drawdowns relative to total returns on an annual basis (click to enlarge):

It is paramount for all of us – investors, managers and clients – to remember to stick to our long term investing goals. Market dislocations like the past two days are common and may become more frequent as market volatility increases back toward normal historical levels. The worst response is to sell stocks after they have fallen, turning a temporary loss into a permanent one. Your asset allocation is based on your long-term goals and the ability to handle market volatility. Keeping a focus on those goals and constraints is far more important than daily changes in stock market prices.

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

image001.png@01D41F46.8B1A85D0“>

image001.png@01D41F46.8B1A85D0“>